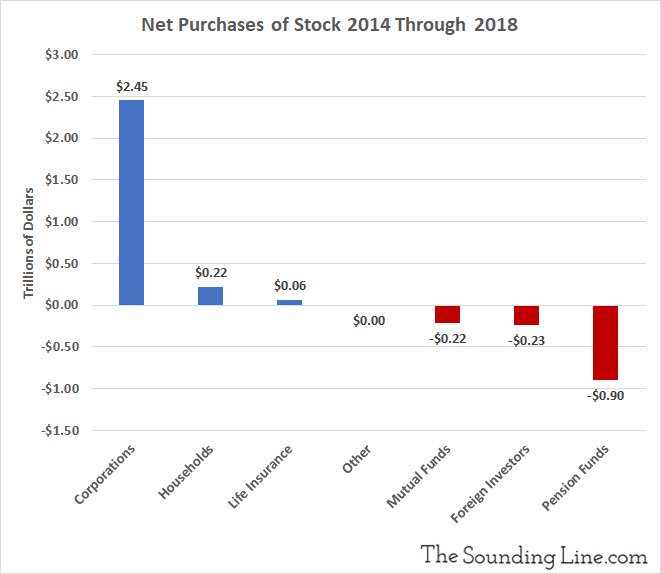

Who in the world has been buying stocks at increasingly speculative-grade valuations over the past five years? As charted below, the biggest net buyers have been public corporations themselves as manageme nt used liquidity driven by central banks to buy back shares and drive their prices higher.

nt used liquidity driven by central banks to buy back shares and drive their prices higher.

Not only has the activity fabricated the majority of paper earning gains and diverted funds from critical areas like operations, R&D and capital investment, but many companies have borrowed heavily to do so, and thus depleted their strength and opportunity fund for meaningful investment in the years ahead. There is a reason that corporate earnings are a historically mean-reverting series; this time will not be different.

It’s been a lucrative short-term strategy for executives who have sold their personal holdings into the flow created. But it’s also a blatant conflict of interest in their duty to broader company stakeholders like employees, creditors and others counting on the viability and sustainability of the company’s operations longer-term.

As share prices plunge, and profits retreat in the downturn, the folly of so much wasted capital will be widely evident once more. Individuals and pensions that have been riding corporate buyback flows, through increasing equity exposure, and confusing rising prices with investment acumen in recent years, are also due for a harsh awakening.