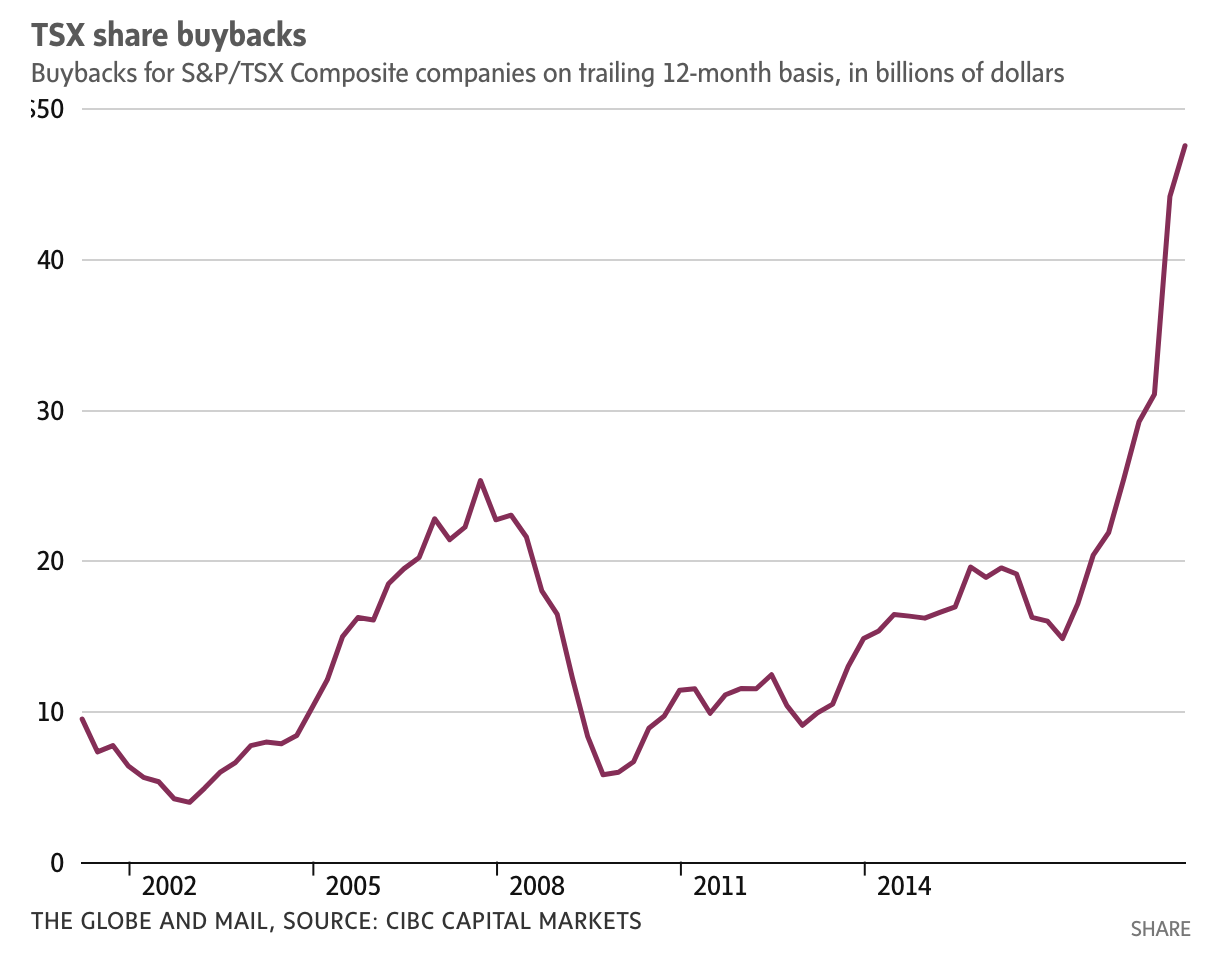

Further to my article yesterday on the capital malinvestment in record corporate buybacks at cycle high valuations in equity markets, the Globe and Mail reports that corporate buybacks of TSX-listed companies also reached an all-time high of nearly $50 billion in the 12 months ending March 31, 2019, and nearly 50% higher than the previous mania peak in 2007. Below is the chart of TSX-listed buybacks since 2001, see Buybacks soar on TSX, but there’s a downside:

Banks and energy companies have been leading the charge as both face slowing profit growth and markets over-supplied with their product. At the end of a record-long economic expansion, the prudent thing to do would be to shore up cash and capital ratios for the downturn now due.

Banks and energy companies have been leading the charge as both face slowing profit growth and markets over-supplied with their product. At the end of a record-long economic expansion, the prudent thing to do would be to shore up cash and capital ratios for the downturn now due.

Unfortunately, the c-suite remains fixated on temporarily levitating share prices rather than shoring up fiscal strength and diversifying business models. Past cycles confirm that debt-heavy businesses will increasingly need to slash expenses and divert shrinking cash flows toward debt repayment. This will leave fewer funds for everything else, including buybacks.