The US Fed hopes that a 1.5% policy rate along with $60 billion a month in ongoing liquidity injections will be enough to keep stock markets afloat and avert a recession. But monetary efforts work at a lag of many months, and a global downturn is already well underway. An unprecedented decade-plus expansion of record debt and asset valuations have compounded financial risks from here.

While borrowing to buy back their shares has been the main support for large-cap companies this cycle, it has not helped Canada’s TSX to advance even 5% over the last 5 years (in red below since 2015). The more economically sensitive index of small-cap Canadian companies (CDNX in blue), meanwhile, tells the trend of global demand with a 48% decline over the same period–and, so far, still falling.

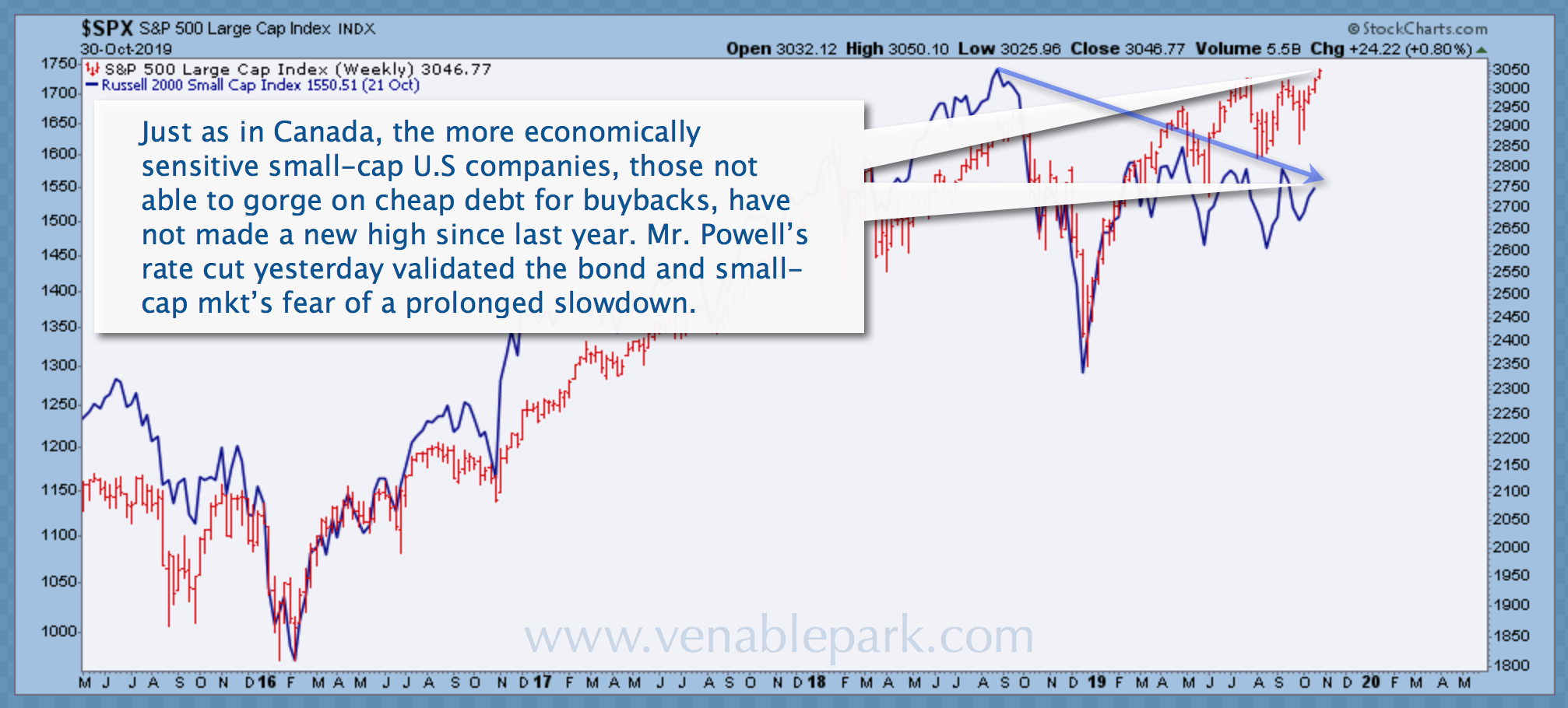

A similar story is evident in the chart below of the Trump-tax cut-buyback-buoyed S&P 500 index (in red below) since 2015. Big caps have bounced back from their 2018 sell-off (though only 7% made new highs this quarter), but the more economically sensitive US small-cap companies (Russell 2000 in blue), are back where they were in October 2017.

Importantly, with corporate debt today at harrowing highs, buyback plans have tumbled for 2020 along with executive optimism–not just for CEO’s, the majority of CFO’s surveyed think a recession will be underway within the next year and they’re looking to cut costs.

It’s wise to recall that rate-cutting cycles are a reaction to downturns, but they aren’t inoculation for the economy or financial markets. As shown below, in my partner Cory Venable’s updated chart of the S&P 500 since 1999, rate cuts came fast and furious into the last recessions and still broad markets halved and small caps fared worse. The case for a better outcome this time isn’t good. Heads up.