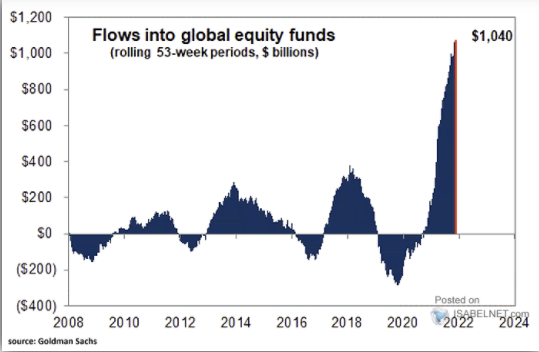

More than $1 trillion of trend-following capital flowed into global equity exchange-traded funds (ETFs) over the past year–exceeding the combined total of the past 19 years (data: Bank of America Corp. and EPFR Global.) The chart below offers a visual courtesy of ISABELNET.com. Passive funds tracking U.S. equity indexes accounted for most of that inflow.

Funds held in ETFs globally have now moved toward $9.5 trillion and more than twice the amount at the end of 2018. Under the surface, half of the index gains between April and December, came from just five companies–Microsoft, Alphabet, Nvidia, Tesla and Apple–while the majority have fallen. The average S&P 500 company closed 2021 -11% from its 52-week high.

Funds held in ETFs globally have now moved toward $9.5 trillion and more than twice the amount at the end of 2018. Under the surface, half of the index gains between April and December, came from just five companies–Microsoft, Alphabet, Nvidia, Tesla and Apple–while the majority have fallen. The average S&P 500 company closed 2021 -11% from its 52-week high.

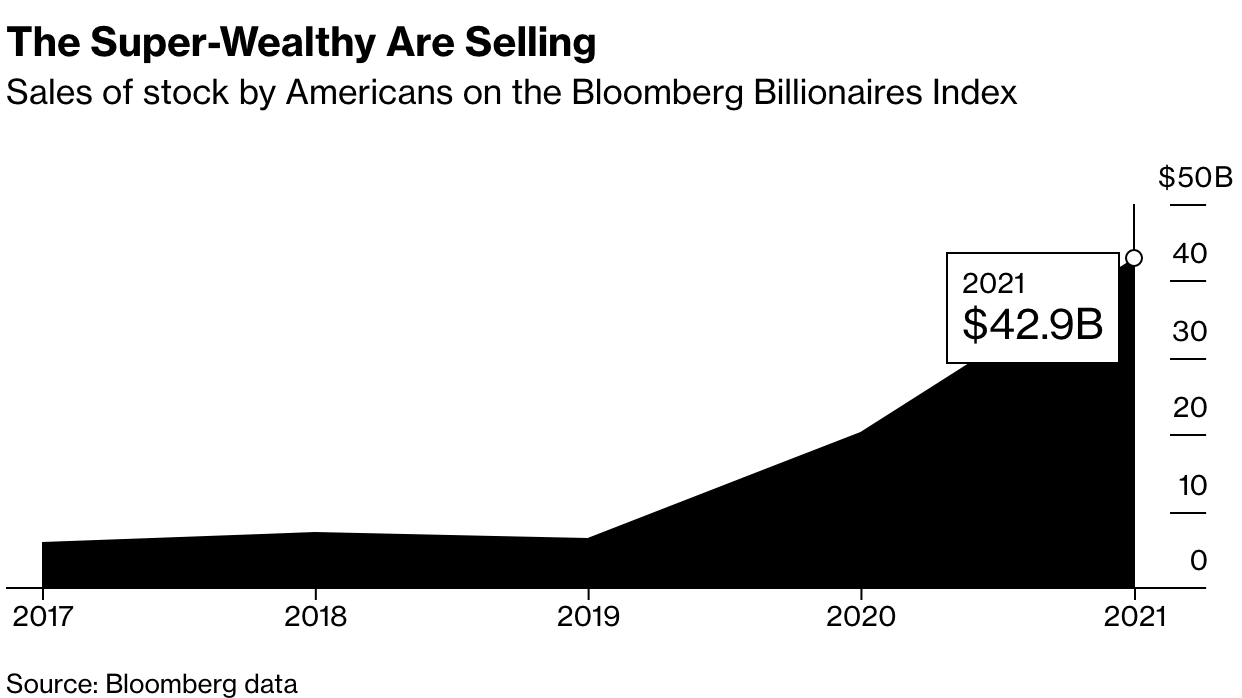

Meanwhile, those who have become billionaires starting and running companies have been using the opportunity of frenzied retail and institutional buying to reduce their risk and raise cash by selling into the retail flow.

This is the number one best way to get rich using the stock market: start or help build a company and then cash out by selling a whack of your equity to the public when outsiders are optimistic about your story. There’s a reason this cycle has long been dubbed from strong hands to weak. See Mark Zuckerberg sells stock every day, as billionaires cash out:

Super-wealthy Americans including Jeff Bezos, Elon Musk and Mark Zuckerberg unloaded $42.9 billion in stock through the start of December. That is more than double the $20.2 billion they sold in all of 2020, according to an analysis of transactions by U.S. billionaires on the Bloomberg Billionaires Index, Ben Steverman reports on “Bloomberg Daybreak: Asia.”

Here is a direct video link.

The best way for company outsiders (the public) to make money in the stock market is to build their cash during the mania of retail FOMO-buying and wait to be one of the few able to buy from the masses when they are liquidating in a panic once again.

All of the excesses of the last decade assure us that a historic liquidation cycle is coming–of that, we can be confident.