To further compound the financial pain in motion, Canadians have recently increased their allocations to equity portfolios, funds and ETFs. RSP contributions due by March 1st are now pounding into equity-based products as I write. As usual, these flows are moving without considering value, cycles or the massive downside risk.

At the same time, the investment sales force loves turning small accounts into larger profit centers by recommending that their customers’ borrow to invest’. Ah yes, the “getting your money working for you” meme. Genius!

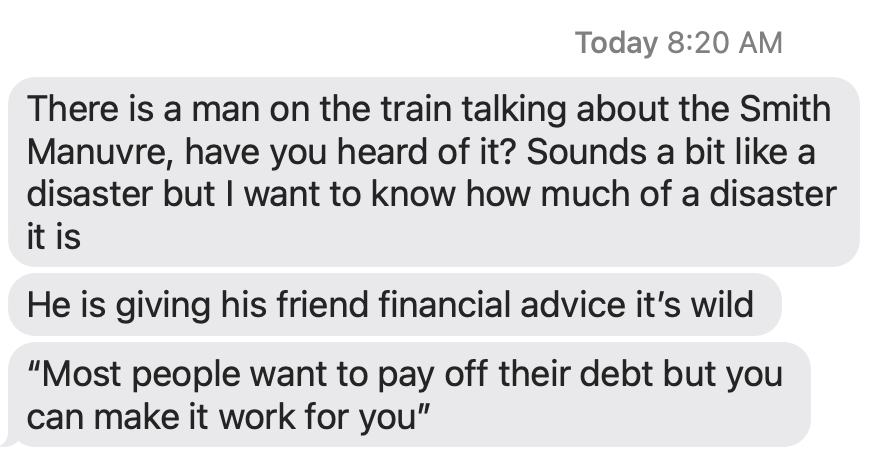

Riding the train to work in downtown Toronto this morning, my 23-year old daughter overheard two men talking loud enough for many to hear and sent me this text:

Sadly, she is one of few who would naturally sense this is terrible advice, #proud mamma, what can I say.

Yesterday, I was contacted by a 30-something engineer who’s been advised to scoop out what equity he has in his condo to buy cryptocurrencies. NIGHTMARE.

When risk assets fall, debt levels will remain, and leverage ‘strategies’ will, once more, be life-altering in all the wrong ways. If home prices fall as well, the carnage will be extra harsh.

If you know someone considering borrowing to buy financial products through the “Smith Maneuver” or otherwise, please send them this article. They can drop me an email for a second opinion.