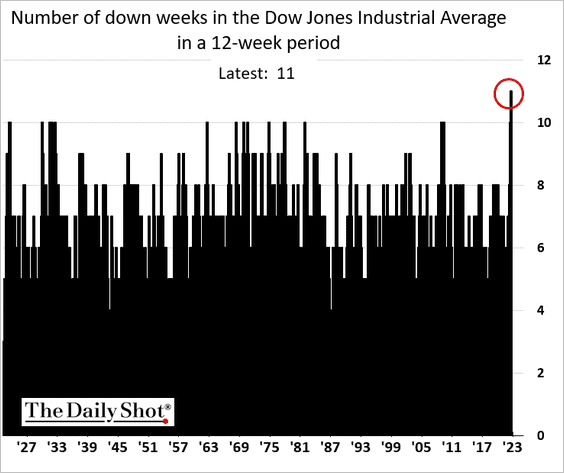

Cryptocurrencies are bid this morning, and US markets are reopening with a bounce following the steepest losses since March 2020 (the S&P fell 5.8% last week, -10% this month so far). As shown below, courtesy of The Daily Shot, the Dow Jones Industrial Average (supposed to be more ‘conservative’) has fallen 11 of the past 12 weeks for the first time since at least 1926.

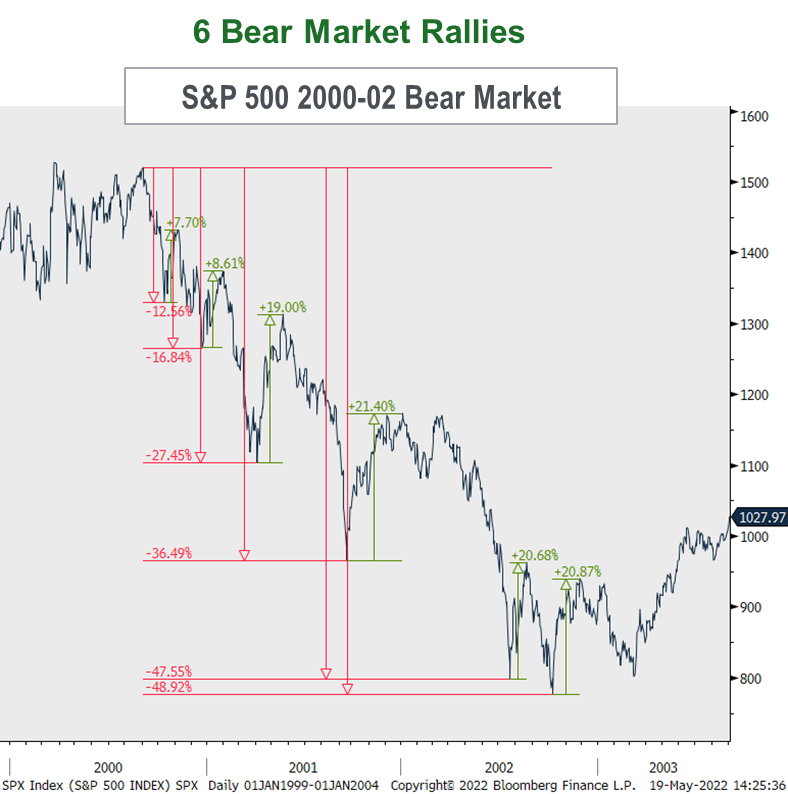

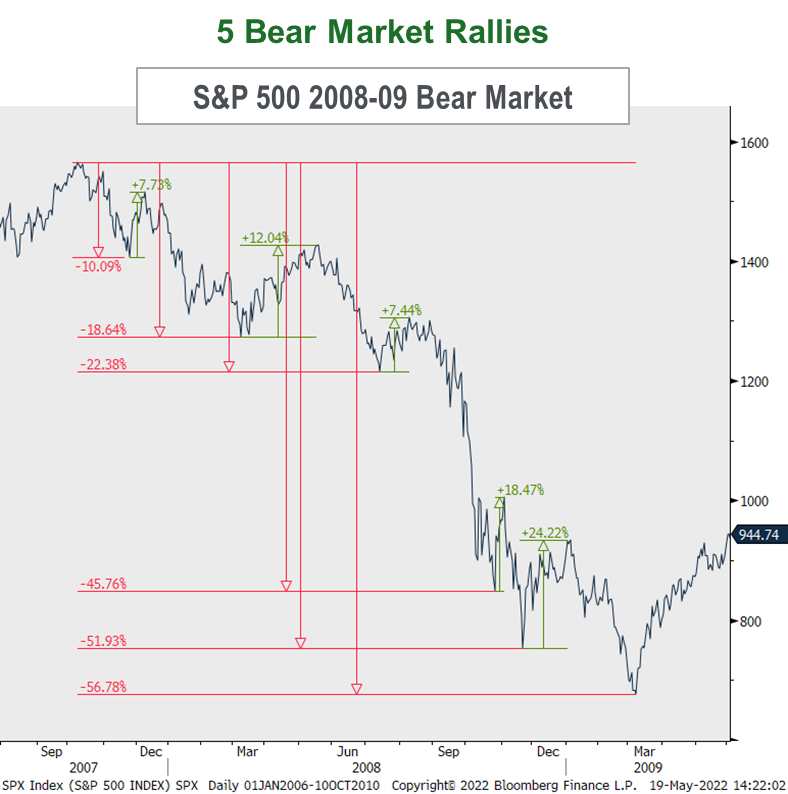

Short interest bets have now piled on, which can set the stage for a sharp rebound. It’s important to remember that interim rallies tend to get more extreme as bear markets proceed to lower lows. As shown below, courtesy of Michael Kantro, the 2000-02 bear had six counter-trend rallies (the final three being more than 20%), while the 2007-09 bear had five (the last two being more than 18%).

Short interest bets have now piled on, which can set the stage for a sharp rebound. It’s important to remember that interim rallies tend to get more extreme as bear markets proceed to lower lows. As shown below, courtesy of Michael Kantro, the 2000-02 bear had six counter-trend rallies (the final three being more than 20%), while the 2007-09 bear had five (the last two being more than 18%).

So far, the 2022 bear has had three rallies, as shown here.

So far, the 2022 bear has had three rallies, as shown here.

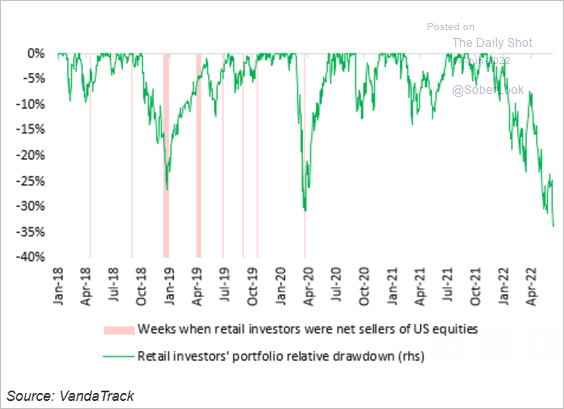

As noted yesterday in Bear Market Update, rebounds will likely be fleeting as long as central banks remain in monetary tightening mode (not yet loosening), a recession is just beginning (not 2/3rds through), and retail investors are not yet liquidating. As shown below, courtesy of the Daily Shot, while the average retail investor is sitting with a 35% drawdown in their portfolios year-over-year, they have not yet become net sellers of equities (like they were during the pink bar periods below since 2018).

As noted yesterday in Bear Market Update, rebounds will likely be fleeting as long as central banks remain in monetary tightening mode (not yet loosening), a recession is just beginning (not 2/3rds through), and retail investors are not yet liquidating. As shown below, courtesy of the Daily Shot, while the average retail investor is sitting with a 35% drawdown in their portfolios year-over-year, they have not yet become net sellers of equities (like they were during the pink bar periods below since 2018).

Lastly, risk assets remain far from historically cheap even with the recent declines, and the consensus is still expecting economic expansion and S&P companies to report double-digit earnings growth through 2022 (source: FactSet). So, negative surprises are set to hit hard.