The video below from the Wall Street Journal offers a helpful refresher on how asset bubbles move. Worth the 7 minutes.

Asset bubbles are easy enough to define, but not so simple to identify. WSJ’s Gunjan Banerji explains what bubbles are exactly, how they form and what happens when they burst. Here is a direct video link.

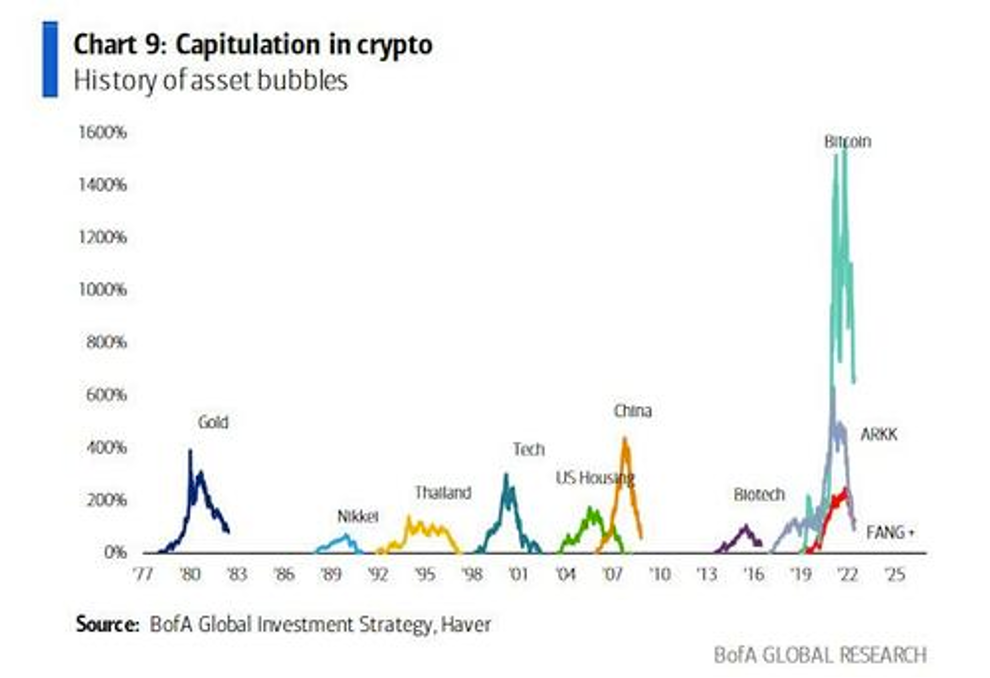

It is pretty easy for clear-eyed analysis to see asset bubbles. The challenge is in predicting when they will burst. But the bust is assured. The chart below shows the price cycle during some of the most infamous bubbles since 1977. Bitcoin (and the crypto-mania around it) is genuinely a standout. Also, see The fire burning beneath crypto’s meltdown:

Also, see The fire burning beneath crypto’s meltdown:

The irony in all this is that part of the original appeal of crypto was the cap on how many bitcoin can ever exist, something supposed to prevent the sort of unlimited money creation that worries many critics of government-issued, or “fiat,” currencies. Rather than unlimited creation of bitcoin, crypto ended up with unlimited proliferation of new tokens. The new structures of intermediaries and defi tools allowed even bitcoin to be reused or lent on, meaning multiple people thought they owned the same token. Lender Celsius Network is an extreme example: Those who deposited bitcoin and other tokens there were promised high interest rates, but have been unable to get their coins—which Celsius lent out—back.