When bank economists get bearish, you know that data looks pretty dour. Kudos to Robert for candour in this interview.

Robert Kavcic, senior economist at BMO Capital Markets, joins BNN Bloomberg with his perspective on Canada’s July GDP data, which Kavcic says was flat. He says all told, assuming growth remains modest in September as the impact of high-interest rates continues to bite, that leaves the Canadian economy on track for a flat-to-very low positive print for all of Q3. Kavcic says the Bank of Canada still has their eyes on stubborn core inflation and firm wage growth. Here is a direct video link.

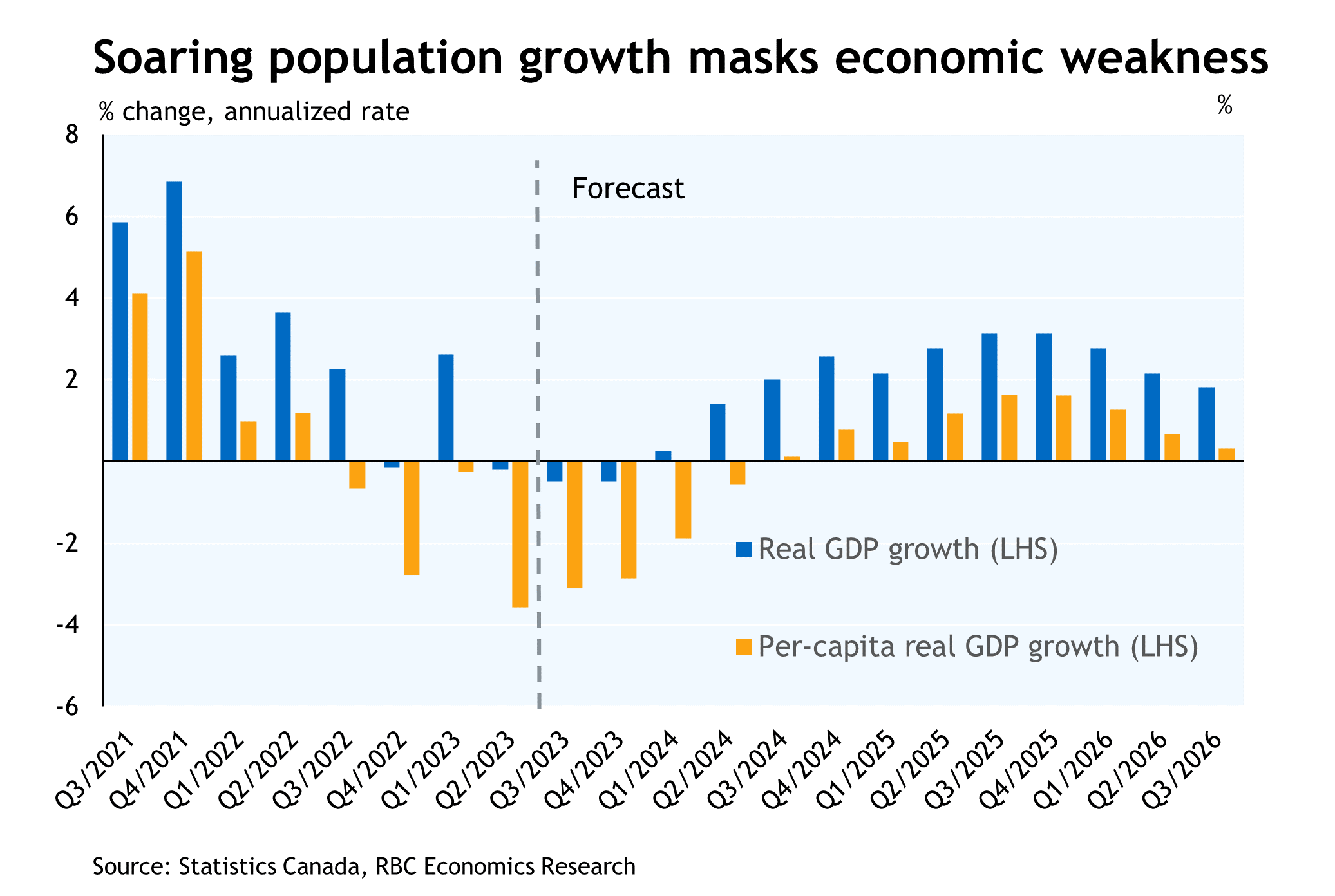

The chart below shows Canada’s real GDP (in blue since 2021) and the grim per capita reality (in yellow). Canadian consumer sentiment is negative for a reason: there are increasingly fewer resources to go around.

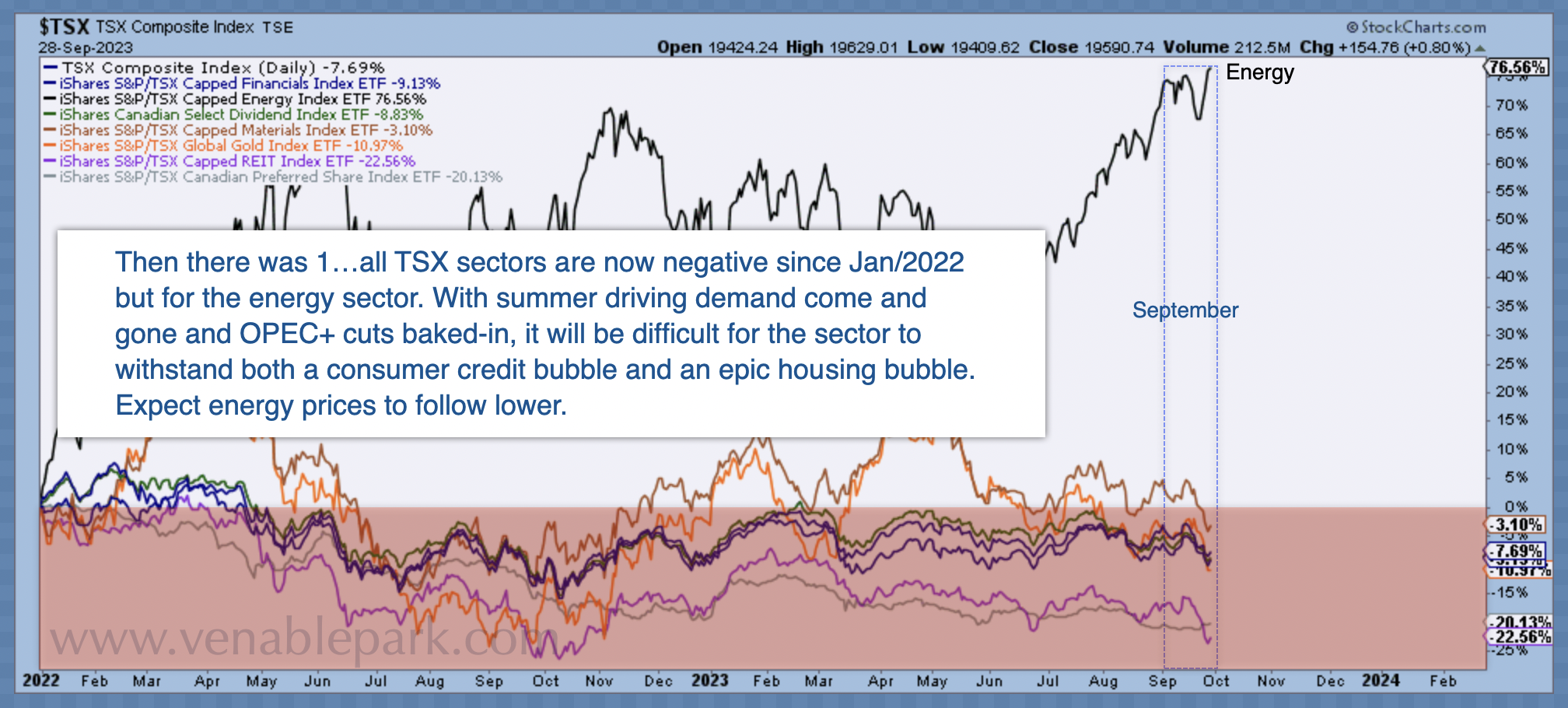

It’s no wonder that even with ‘free money’ mania in 2021, Canada’s TSX (below courtesy of my partner Cory Venable) has gone nowhere in 28 months and gained just 1.91% annualized since the last cycle top in May 2008 (when oil was topping $140 a barrel).

A mild 20% bear market from here would evaporate the TSX’s price progress over the last 15 years (see red band). A 40% bear market (similar to in 2000-02 and 2008-09) would expunge all price gains since the August 2000 top–23 years ago. Believe it or not.

It bears remembering that oil price spikes are typical late-cycle and help to trigger price-deflating recessions and global demand destruction. Fossil fuel companies (18% of the TSX index, top black line below) have been the only sector propping up the Canadian stock market since January 2022. Meanwhile, the financial sector (30% of the index) continues to lead the broad market and economy lower from here. Financial shares, -19% so far, are not yet discounting the magnitude of the credit crunch presently unfolding.

Most investors are holding portfolios designed to track the broad indices lower from here. Worse this cycle, Canada’s record debt and mean-reverting real estate market will magnify the pain.