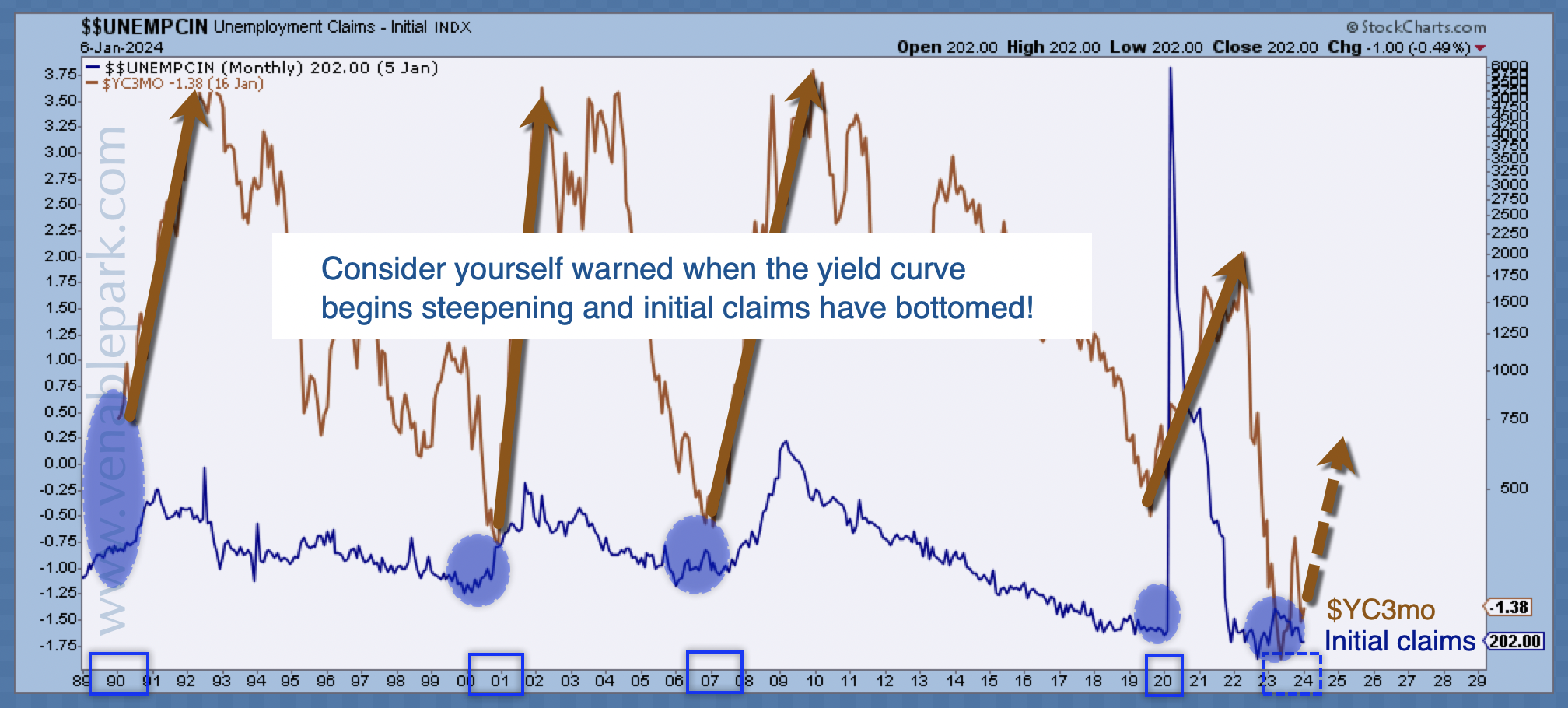

The US 10-2-year Treasury yield spread (via YCharts below) has moved from a deep inversion at 108 bps last July to -14 bps today. This process is known as re-steepening. Re-steepening of the yield curve (10 minus 3-year spread in brown below since 1989, courtesy of my partner Cory Venable) has historically coincided with rising unemployment claims (in blue). So, it’s no surprise that layoff announcements are now picking up.

Re-steepening of the yield curve (10 minus 3-year spread in brown below since 1989, courtesy of my partner Cory Venable) has historically coincided with rising unemployment claims (in blue). So, it’s no surprise that layoff announcements are now picking up.

For stocks, corporate debt and commodities, re-steepening of the yield curve has historically signalled the worst part of bear-market losses, with the S&P 500 falling an average of 30% from the onset of the persistent 10-2-year inversion (which began in July 2022 this cycle).

For stocks, corporate debt and commodities, re-steepening of the yield curve has historically signalled the worst part of bear-market losses, with the S&P 500 falling an average of 30% from the onset of the persistent 10-2-year inversion (which began in July 2022 this cycle).

Good overview of the present market cycle in this segment.

DoubleLine Capital CEO Jeffrey Gundlach provides his 2024 market outlook and weighs in on the Fed’s inflation fight on ‘Making Money.’ Here is a direct video link.