The rise of extreme income disparity over the past 20 years may be misunderstood without historical context. In 2016, the combined wealth of the richest 1% of the world’s population is on track to overtake that of the other 99%. That’s one point of reference.

The gap between the rich and everyone else is widening. Here’s a look at why. Here is a direct video link.

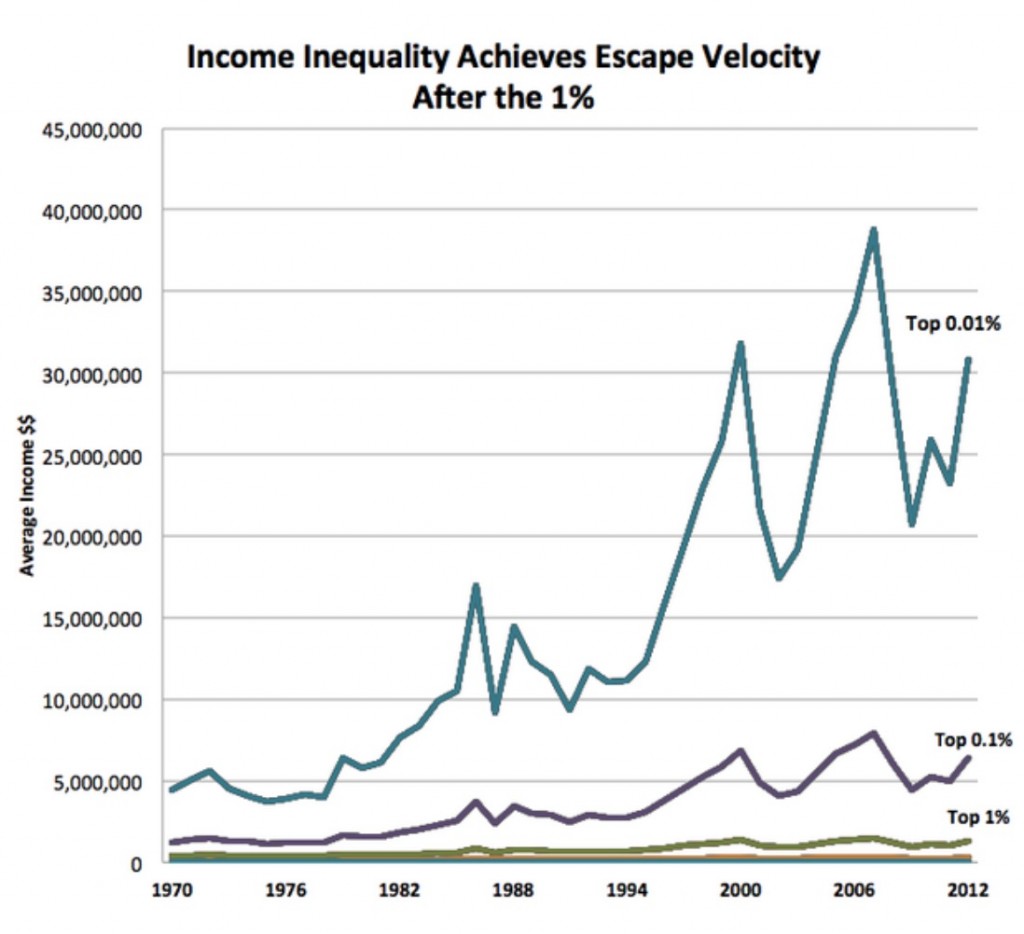

More to the point however, is the remarkable top line on the following chart: the relative income gains of the top .01% of the population versus everyone else.

In many ways, the surreal gains of the .01% are inversely related to the financial deficits currently plaguing the rest of the world. Multinational conglomerates have benefited most from the bailouts, corporate welfare, tax loopholes, debt financing and incessant asset propping underwritten by governments and central banks the past 20 years. As shown clearly above, the windfalls of the top .01% have been highly correlated with the global credit bubble that has siphoned financial strength from the many for the grotesque enrichment of a few.

In many ways, the surreal gains of the .01% are inversely related to the financial deficits currently plaguing the rest of the world. Multinational conglomerates have benefited most from the bailouts, corporate welfare, tax loopholes, debt financing and incessant asset propping underwritten by governments and central banks the past 20 years. As shown clearly above, the windfalls of the top .01% have been highly correlated with the global credit bubble that has siphoned financial strength from the many for the grotesque enrichment of a few.

A further related and disturbing trend, is the fact that the top .o1% (25,000 in America) now donate more than 40% of the country’s political contributions. As a comparison, in 1980, .01% of the American population contributed 16% of all campaign contributions, Here is a recent chart from CROWDPAC showing the rise since 1980. See: How much do the 1% of the 1% control politics?

Actionable steps are needed to get corporations off the public purse and back into smaller, separate entities held at arm’s length with greater restrictions on lobby access, political contributions and revolving door employment between the two. In particular, key areas for immediate focus are these:

- Break up too big to regulate corporations back into smaller, accountable entities.

- Legislate much lower limitations on the political contributions of any one individual, company or sector. (Yes, Citizens United was a ridiculous decision.)

- Move liability and insolvency risks back on to the executives, partners, and directors and away from the public purse. No more government bail outs of the private sector.

- Put Glass-Steagall divisions back between banks and security/debt broker/risk sellers.

- Prevent product sellers from styling and marketing themselves as ‘advisers’.

- Prevent corporations from negotiating fines unless their directing officers admit and accept punishments personally for their illegal actions and failures of duty.

- Require executive bonuses be paid in corporate debt not mostly equity.

- Legislate a mandated time break of several years before representatives are permitted to come out regulatory/government agencies and into jobs in the corporate sector. (Ben Bernanke’s lucrative consulting gigs for HFT and others is just one shameless example in a long list the past few years.)

Senator Elizabeth Warren referenced a few of these themes on April 15, 2015, at the Minsky Conference in her speech: “The Unfinished Business of Financial Reform.” You can find the audio link to the recorded speech here. This quote is a taste:

“This is an economic fight, but this is also a political fight. The biggest financial institutions aren’t just big – they wield enormous political power. Last December, Citibank lobbyists wrote an amendment to Dodd-Frank and persuaded their friends in Washington to attach it to a bill that had to pass or the government would have been shut down. And when there was pushback over the amendment, the CEO of JPMorgan, Jamie Dimon, personally got on the phone with Members of Congress to secure their votes. How many individuals who are looking for a mortgage or a credit card could make that call? How many small banks could have their lobbyists write an amendment and threaten to shut down the US government if they didn’t get it? None. Keep in mind that the big banks aren’t trying to make the market more competitive; they just want rules that create more advantages for themselves. The system is rigged and those who rigged it want to keep it that way.”

Let us be clear. The complaint about inequality is not that some people have much more money than most. The complaint is that self-interested groups of some of the wealthiest people and corporations are having undemocratic influence and control over the political process, banking system and policy decisions.

Just as unfair and damaging as any dictatorship, the influence and advantage that a select group of people are buying themselves is undermining the health, stability and progress of a free and democratic society. None of us can afford to let it continue.

In the meantime, we should expect more civil unrest and rioting as increasingly disenfranchised masses have less and less to lose and every reason to buck the status quo.