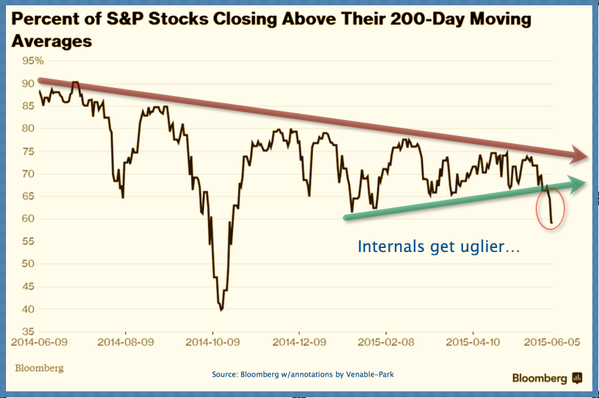

Since May highs, North American stock indices have weakened modestly, with the Dow down over 3%, the S&P down 2.6% and the Canadian TSX 4.4%. In reality however, broad indices mask the impact on individual sectors. As shown below, the percentage of stocks in the S&P 500 closing above their 200 day moving average is falling, and suggests more weakness may lie ahead.

Since January, interest sensitive sectors have fared much worse with Dow Utilities -14.8%, Dow Transports -10.5%, Telecom index -10.6% and REITs -13.7% so far. See: Trendless market showing weak spots.

Unfortunately it is dividend paying sectors–the one’s most widely held by retirees and others looking for “conservative” income investments–that are some of the most outrageously overvalued in today’s low interest rate environment. They are also the assets into which brokers, mutual funds and long always advisers have herded clients the most.

This is why the next bear market, will be so brutally hard on individuals following conventional investment advice.

As a reminder, the below chart is what dividend stock out-performance looked like (in blue) versus the broad market (in red) during the 2007-09 bear market: the S&P lost 45%, and dividend stocks ‘only’ 36%. ‘Solid investments’ for whom?