Enjoying the Globe at our Saturday coffee shop this morning, I came across a little article which sums wonderfully the conflicted mess we call the ‘investment business’ see: Dundee Corp. share exchange under fire.

Evidently fund company Dundee management has come under criticism for solicitation fees it is paying brokers to convince Dundee preferred shareholders not to take cash owed to them on a maturity next summer, but rather to roll over their capital for another 3 years. Shareholder rights groups and some money managers have called the payments “a huge conflict of interest” and “coercive”. The article then quotes new Dundee CEO David Goodman with this knee-slapper that nearly caused me to spit out my coffee:

“I have a very high appreciation for the integrity of and value that the financial advisers provide and I don’t believe that the receipt of a solicitation fee for their services is going to compromise their ability to properly advise their clients.

Good one right?

I have not been following Goodman and company or Dundee but the article explains “Dundee is under financial pressure having lost more than $400 million in the year to date, primarily due to heavy exposure to the cratering resource sector.” This reminded me of a panel I did at the Toronto investment conference in September 2013 with then CEO, a supremely confident Goodman senior. I wrote about it here with a link to the panel video and the following comments:

(All of which reminds me of some embarrassing assertions made by Dundee’s Ned Goodman on an investment panel I did with him in 2013 (clip is here) where he was saying the Fed would never tapper QE in his life time (at 1:30 min) while talking up insatiable Chinese growth and confidently assuring the audience that there were no such thing as Chinese ghost towns (see our exchange starting at 6:58)…hmmmm).

(I’ve done a lot of panels in my time, with a lot of different money managers, but truly this performance was ‘memorable’)

In any event, Goodman and company may be getting what they deserve for being brutally wrong on their analysis but they had already personally cashed out when Scotiabank bought the bulk of their management business for $2.3 billion in 2011 (at $21 a share).

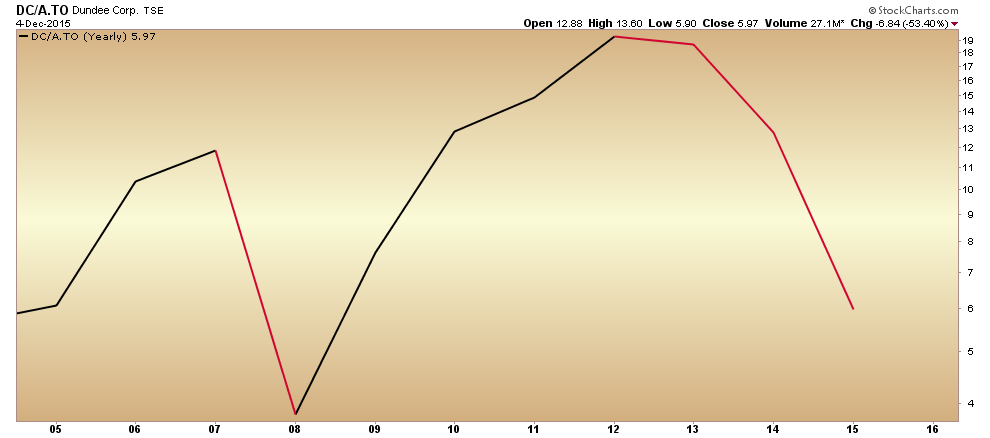

Unfortunately it is retail investors who have once more been hammered in all of this mess. The chart since 2005 tells the story: the stock is down more than 53% in the past year and just under 75% since 2013. Just another tale as old as time in the marketing machine otherwise known as the ‘investment business’.