The Willshire 5000 is considered the definitive US stock index reflecting the market cap of most publicly traded companies headquartered in America (3,691 as at 2015). As such, it includes the majority of common shares and REITS traded through the New York Stock Exchange, NASDAQ and AMEX. And as shown here since June 2014, the Willshire has been tracing out a pretty classic-looking topping pattern since late 2014.

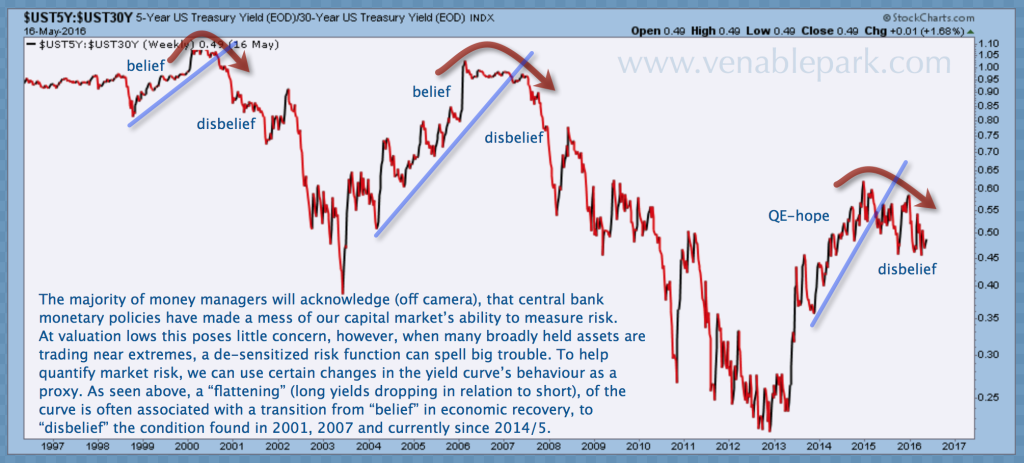

At the same time, US bond yields seem to agree with the Willshire’s woozy outlook. As shown below, the spread between 5 and 30 year US Treasuries has been flattening since 2014 as well. We noted a similar pattern and growth-non-confidence-vote from the treasury market leading into the recessions and stock bear markets of 2001 and 2007. Noteworthy formations.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In