Broke buyers, desperate to move product-well-past reasonable-demand-manufacturers and dealers, along with price indiscriminate-desperate-to-dump-capital anywhere ‘investors’ have made a big mess once again. See ‘Deep’ Subprime Car Loans hit Crisis-Era Milestone:

Amid all the reflection on the 10-year anniversary of the start of the subprime loan crisis, here’s a throwback that investors could probably do without.

There’s a section of the auto-loan market — known in industry parlance as deep subprime — where delinquency rates have ticked up to levels last seen in 2007, according to data compiled by credit reporting bureau Equifax. “Performance of recent deep subprime vintages is awful,” Equifax said in a slide show on second-quarter credit trends.

Also watch this discussion. Here is a direct video link.

30 year old Portfolio Manager: “I think auto investors know what they are doing here.” LOL!

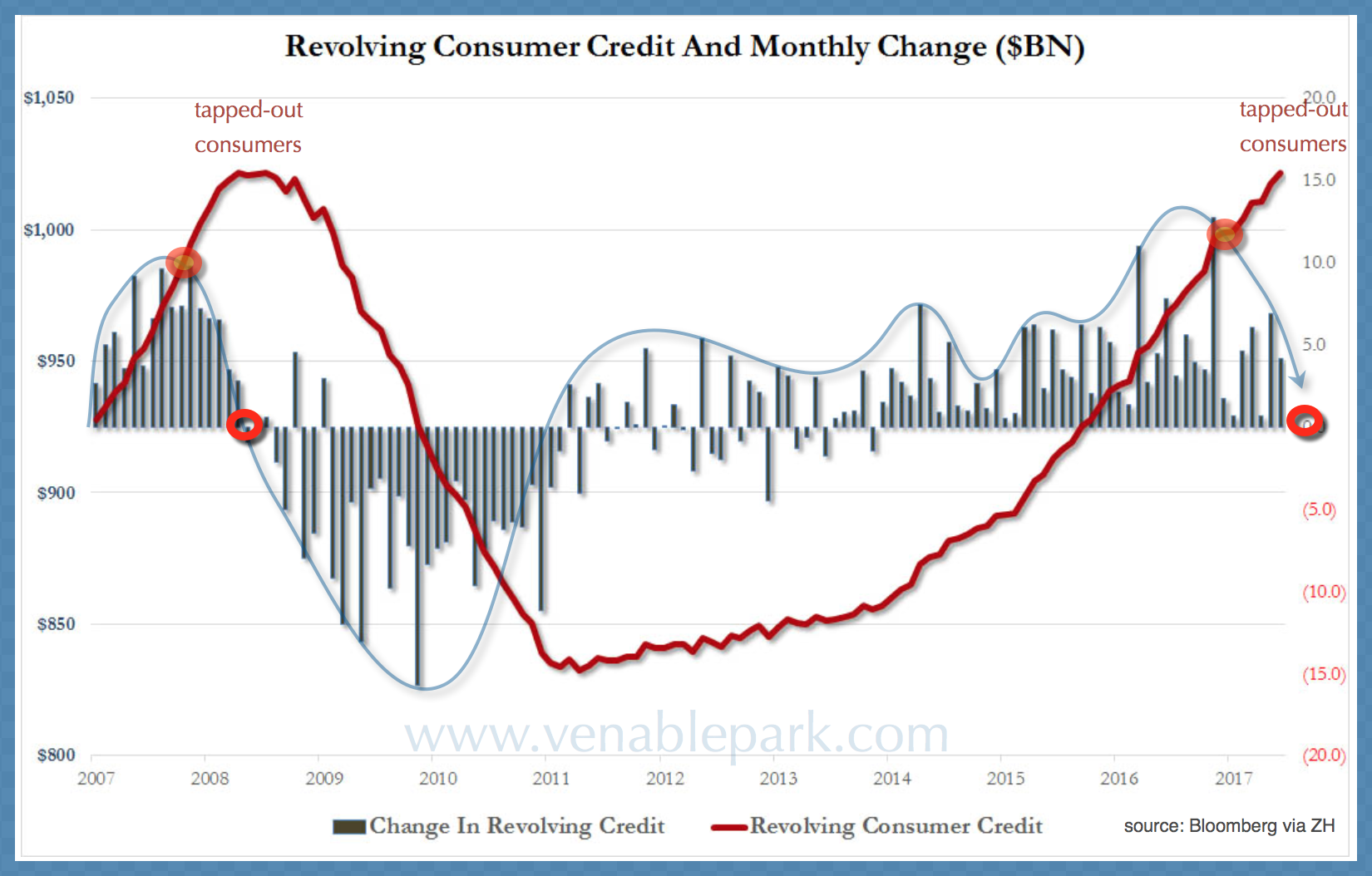

Here is the big picture chart on the US consumer credit cycle since 2007.