In the last decade, the dominant corporate model has been about rewarding short-term extractive shareholders and lenders, at all costs, with the masses dependent on debt to make ends meet. The price has been lost savings and productive investment along with deficits and shortfalls compounding for years into the future.

We don’t empower a nation by taking advantage of the young and vulnerable when they are looking for help to get started. As I explained in Young and old debilitated by debt-dependent business model:

The answer is not more loans, and lower rates and more government subsidies to for-profit-corporations; the answer is more affordable, efficient programs and systems that cost less and enrich the masses with better health, education and self-sufficiency.

Ironically, it took a pandemic to provide the inevitable tipping point. With an abrupt drop in income, keeping up debt-fueled appearances is no longer a possibility for many. Suddenly, there is a perfectly respectable reason to seek the services of an insolvency trustee, downsize, reduce spending and look for ways to share costs.

Two areas that have driven the bulk of household debt in Canada over the last decade have been soaring real estate and post-secondary education costs. Both have now entered into a major reset period.

Evaporation in short-term vacation renters has left many property owners without the necessary cash flow to cover carrying costs at the same time that many long-term renters are falling behind too. This will drive more to consolidate living arrangements while pushing excess supply onto the rental market, increasing properties for sale, and exerting downward pressure for both rents and prices. At the same time, as more people work from home, many no longer need to be living in the most expensive urban centres and migration to more affordable places makes sense. See Condo vacancies rise, rents fall as pandemic crushes GTA’s short-term rental market. Commercial properties are over-concentrated in many previous hot spots too, see: BMO says 80% of employees may switch to blended home-office work.

At the same time, post-secondary schools are being forced to offer their programs online, with the prestigious Cambridge University, England being the latest to announce today that all of its lectures will be online until the summer of 2021.

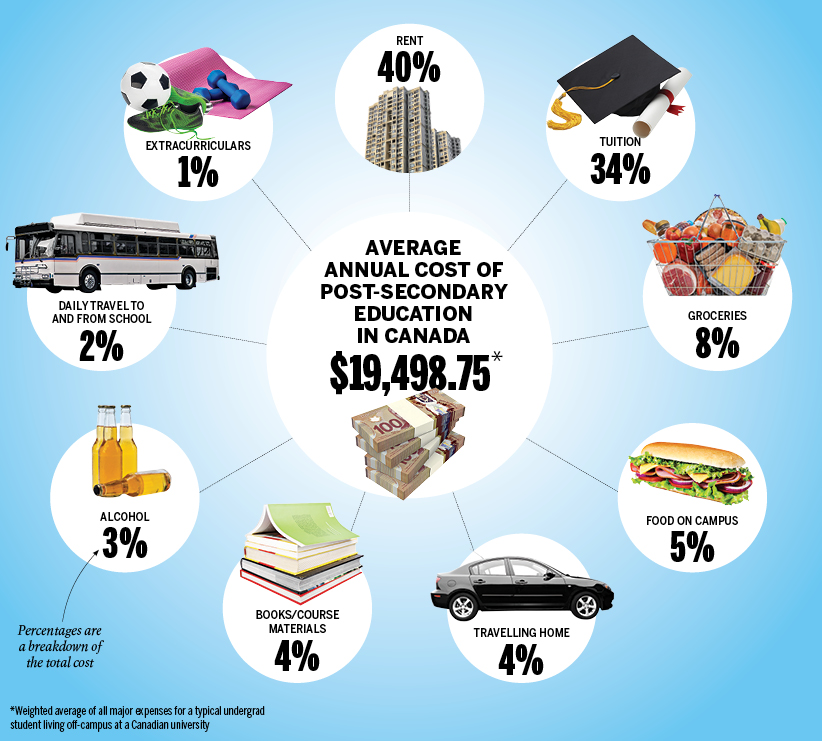

As shown in the chart below, nearly half of the average annual post-secondary costs in Canada are stude nt rent and travel to and from school. With just a third of students having an education fund (RESP) to draw on, funding depends on help from parents, student jobs and increasing debt for both the parents and the students.

nt rent and travel to and from school. With just a third of students having an education fund (RESP) to draw on, funding depends on help from parents, student jobs and increasing debt for both the parents and the students.

With fewer people working and most already indebted, an obvious solution is for students to live at home wherever possible. Online studies make this more feasible than ever. Immigrant families have long benefited by the multi-generational efficiencies of shared living arrangements, other families will do so too.

At the same time, there is an expectation that online education should be less expensive than the on-campus experience, and schools will be pressured to reduce the price of their services.

Shelter and education costs, two of the largest drivers of household debt, are coming down. This is part of a much-needed increase in productivity, reduction in debt, higher free cash flow, and savings for the future. But, in the process, we should expect ongoing consolidation pain in debt-inflated real estate, education and related sectors.