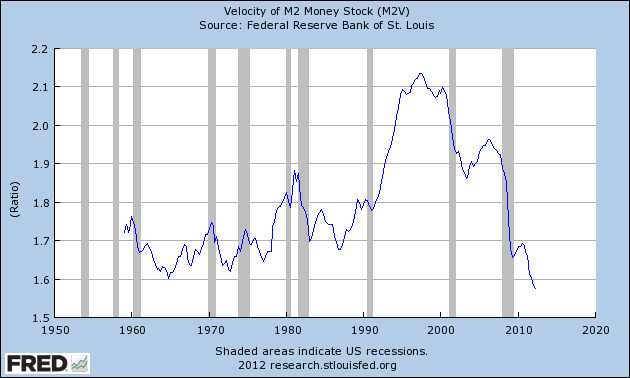

With trillions of (tax-payer funded) monetary stimulus sloshing around the global financial system, traditional economic theory would predict an increased money velocity moving through the real economy. In fact as shown in this updated chart of the US M2 Money Stock, the multiplier effect for the real economy has never been lower. What central bankers are doing today is not economic stimulus. In fact there is evidence that their monetary experiments are actually slowing economy activity: each tranche of QE has caused fleeting bursts of commodity inflation which have caused companies to contain costs by reducing payroll expenses. Central bankers are moving in direct opposition to wage growth today.

Follow

____________________________

Cory’s Chart Corner

Load More____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

Keynesian endgame…

As many observers keep saying (and I agree): it’s all about the banks. This is NOT about the economy, or jobs, or taxes, or whatever. This is about saving the banks from themselves and allowing them to take over as much real wealth as needed to fill the gap of money needed for the shadow banking system to heal. Bernanke is a liar––in his intent if not in his words. Central banks, which are owned by the commercial banks, work for the commercial banks, just as any organization works for its owners––not its employees, or government or whatever. The banks come first. When bank interests are aligned with the economy, then policy makers’ actions appear to be in the interests of the economy. And I’m sure they prefer circumstances where the interests of the banks and the people are aligned, so that everyone wins. However, if it comes to a question of do we save the people or the banks?, the banks will always win. Case in point: Europe. The “leadership” there is more than willing to sacrifice the people to save the banks. Bernanke is doing the same thing here, except the US, being the US, is not in as much trouble as Europe. It’s very simple: the hole has to be filled, the banks must be made whole. And Bernanke and the other representatives of the criminal elite are willing to steal as much as needed from the people in order to make that happen. This should be your number one consideration vis-a-vis your financial plans, because even in Canada, we are affected. The banking system is globally intertwined. Canadian banks interact with the Fed too. The Fed is central bank to the world, in effect. Therefore, all nations that are part of this coordinated effort must debase their currencies along with the US dollar, or it won’t work. Watch China. They are taking steps not widely reported in the media to circumvent the US dollar. One day, we may find the US dollar is suddenly not worth the paper its printed on.