After a wild 4 years of slumps and rallies and trillions of dollars in central bank interventions, the S&P 500 has now managed to rebound 120% from its March 2009 low and is within striking distance of its previous 2000 and 2007 cycle peaks. Interestingly stocks have only ever rallied this much in 4 years, within the context of other on-going secular bear periods in history.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Nevertheless, recent action is prompting the usual trend-following suspects to declare that stock markets are now in the midst of a new secular bull market. In truth there is no reasonable evidence to support this thesis.

Historically every secular bear period in the past 200 years, has ended with bargain basement stock valuations that labor under-bought and under-loved through years of public revulsion of banks, stocks and “market makers”. Today while we have made some progress since this secular bear began in 2000, still elevated valuations (Shiller PE is 22 not 10), meager dividend yields (2% not 8), wildly bullish investor sentiment (twice as many bulls as bears, not the opposite), margin use at cycle highs (not crushed out), Porfolio Managers all in (with the lowest cash levels since the 2000 and 2007 peaks), retail investors now back at median levels of 40% equity exposure (not all out and screaming for the heads of their stockbrokers on a plate), market confidence high with ubiquitous faith in central bankers (not blaming central bankers for disaster), the volatility index showing near comatose complacency (at 13 not 40) consumer debt levels still near credit bubble highs, consumer savings rates anemic (less than 4% not more than 10%), still no serious criminal prosecutions of financial offenders in the works, still no significant changes to the cozy court of bankers and politicians, still weakening household employment, staggering fiscal deficits on top of zero rates and already prolapsed central bank balance sheets.

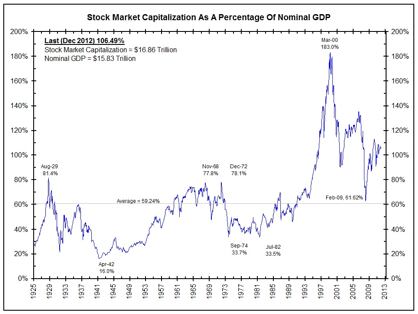

I could go on and on, but I know, wide-eyed optimism feels more fun than facts every day of the week. For those who do care to see truth though, this chart of the S&P market cap as a ratio over US nominal GDP also offers an excellent reality check. We see our own secular bear experience since 2000 here plotted as against the other secular bear periods since 1929. Until S&P valuations give back all of the excess of the prior secular bull period (1982-2000) and labor below the mean line for a period of years, crushing reckless capital and animal spirits into a pulp of misery, law suits, prosecutions and loathing, we are not likely to be through our secular bear yet. That said another very attractive cyclical re-entry point(like 2003 and 2009) is very likely not too far ahead. Those who can see through present noise, protect themselves and keep an eye on the horizon are likely to survive and thrive quite nicely. Moving against the madness of crowds now is the price rational people must pay to earn positive returns and mental strength through today’s extreme market cycles. Click here for larger picture.