As the risk-sellers: broker/dealer/conventional asset management types renew aggressive marketing campaigns to attract new victims (pulling out their finest suits and fanciest board rooms), global GDP continues to contract and most asset markets continue to flash extreme risk warnings to anyone who cares. In this time of perpetual central bank assurances though, most participants have officially stopped looking for risks. Which is precisely why they will be so painfully taken unawares in the end. Always are. All of this reminds of the foolishness of humans–especially those who have learned these lessons before and should know better–a fool and his/her money…it is true. I am reading Taleb’s latest book ‘Antifragile: things that gain from disorder’ and it is so clear that most people are not antifragile: they do not learn and improve their behaviour from periods of stress and adversity–and so they will continue to be victims. Sad.

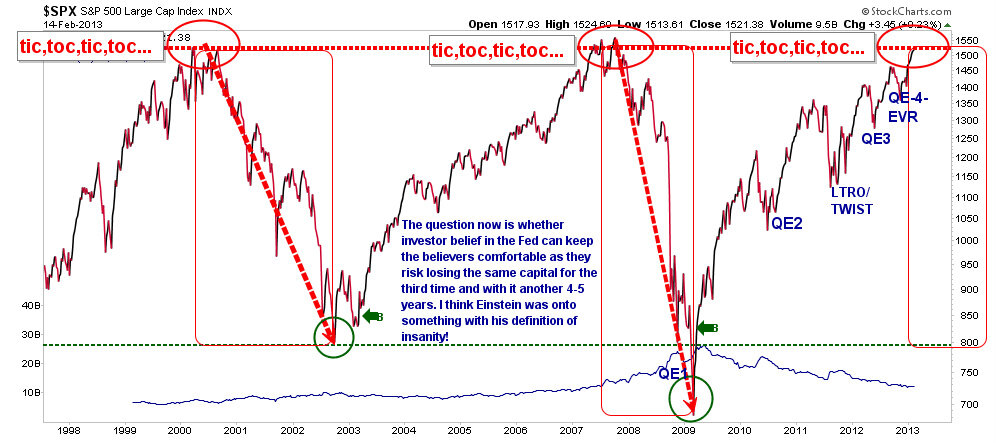

In any event, for those who are still awake, here are some chart updates for your weekend reflection. First the S&P 500, then the Canadian TSX and lastly, the gold company index ETF (XGD) which has now officially broken support.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Okay, you have me convinced. Book SP500 profits and wait to deploy into gold. Got it, right on! I have waited long enough for this bargain to land into my hands, whoopie!