The high-frequency algos went wild blasting millions of buy orders at risk markets yesterday afternoon on headlines that OPEC members might agree in November to freeze production near all time highs. But this morning sober thoughts are dawning that capping output at the highest levels in history–while the many other non-OPEC producers continue to pump-for-their-life amid slumping global demand–is not likely to sop up the excess supply here. This chart of OPEC production since 1990 offers perspective.

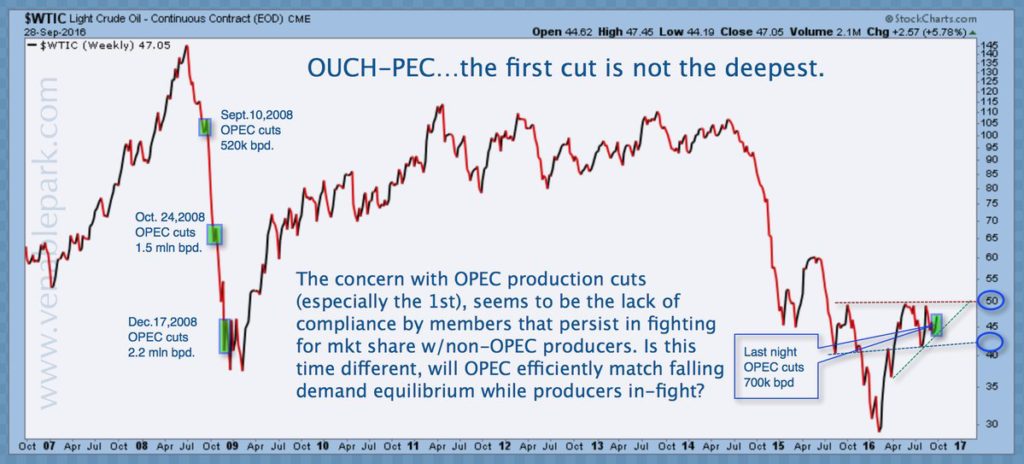

Not only that, but as shown here in my partner Cory Venable’s chart of oil (WTI) since 2007, last cycle in 2008 (when OPEC had more swing sway than today), they also agreed to cut in September after prices had fallen from $148 to around $100 a barrel. They then cut twice more in October and December 2008 as prices collapsed 60% to the $40 range.

Apart from OPEC having less swing influence today, another obvious difference this cycle is that oil prices have already fallen and languished in the $40’s for 20 months since January 2015, and still global demand has continued to weaken.

Like central banks who are observing the economy today with ZIRP bullets rather than that 5%+ of loosening power they wielded in September 2007, global oil producers are not in the position of demand influence they once took for granted.

Today in the mean reversion phase of what was the largest credit-driven supercycle in human history, price cuts–whether on the cost of capital or of oil–are not enough. Consumers, sick and tired from too much consumption, have adopted a new obsession: saving more and spending less. In the process, old prods and masters have lost their potency.