The ability and willingness to borrow to buy has always been a major driver of asset prices–up and down. But as we have highlighted over the past couple of years, it is hard to grasp the crazy extremes that borrowing has run to this particular cycle. See Margin calls bite investors, and banks.

Between 2013 and June 2015, credit rose 35%. NYSE margin debt alone reached a record $505 billion. Brokers aggressively pushed loans onto customers who borrowed against portfolios to buy not just more securities, but also art, cars, boats, real estate, school tuition and living expenses (!). The buying helped drive prices higher even as downside risks went exponential in the process.

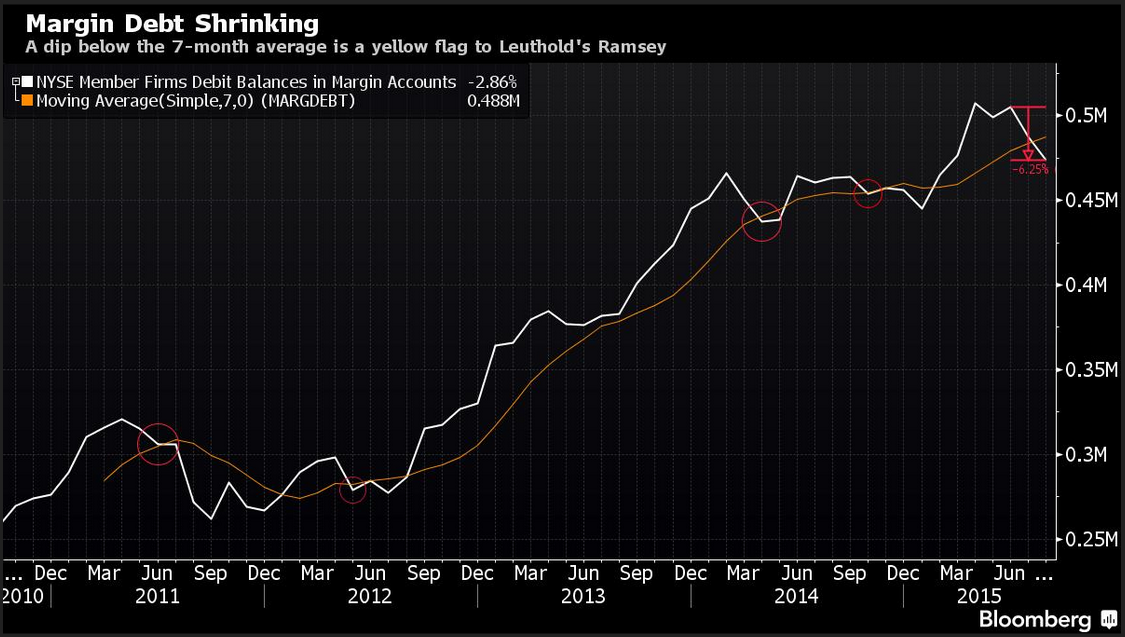

As graphed below, in June the inevitable reversal began with margin debt falling 6.3% to the end of August (latest data) as risk markets contracted. September brought a further 2.64% decline in the S&P 500 and steeper losses in emerging market, small cap indices and high yield debt. This means that the upcoming October reports will no doubt show even further margin compression to the end of September.

Margin reversals of this magnitude (in red) were precursors to both the 2001 and 2008 bear markets (S&P in blue) as shown below. Falling prices force more asset sales to reduce credit balances in a self-deflating cycle of both. History suggests that the extreme magnitude of the debt use this cycle, will have a magnified effect on price declines as well.