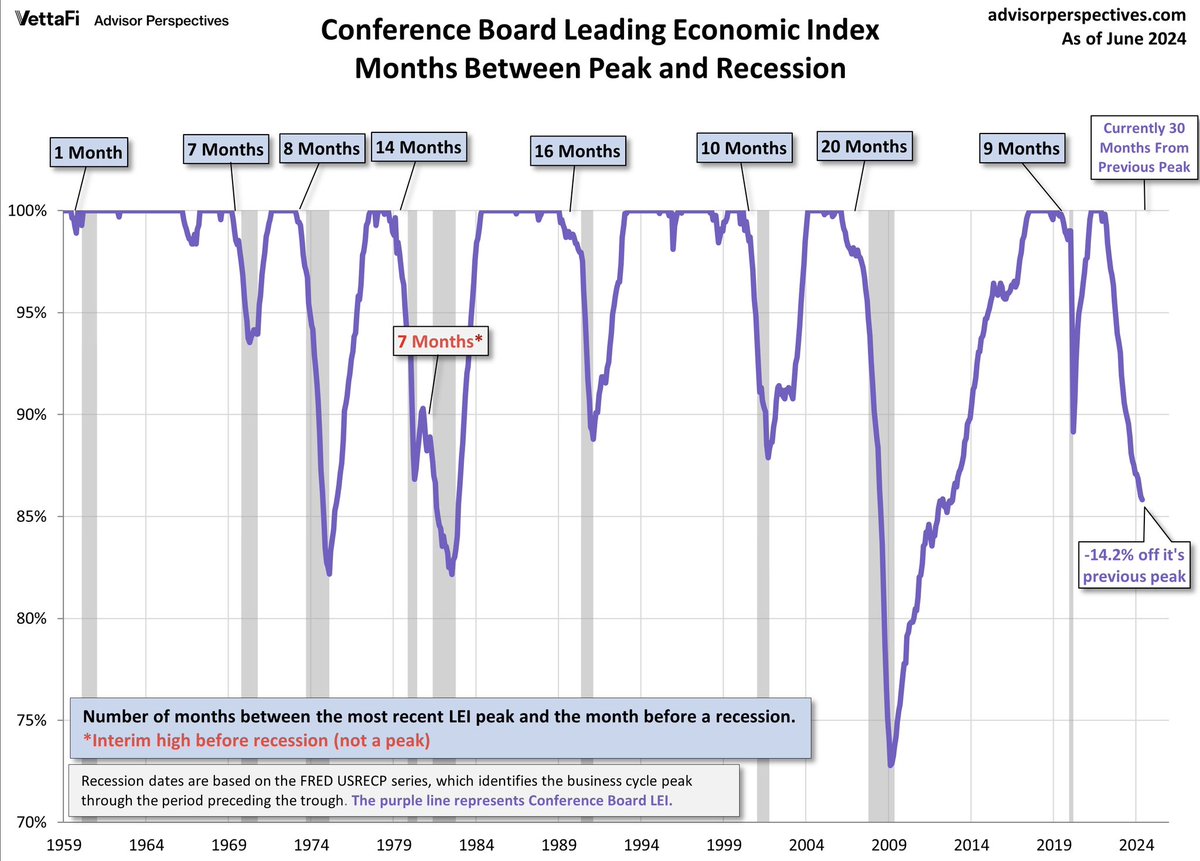

The US Conference Board of Leading Economic Indicators (LEI Index) declined for a 30th month in June (purple line below since 1959, courtesy of Advisor Perspectives) and is now -14.2% from the cycle peak in December 2021.

As shown, since 1959, an LEI contraction of this magnitude has never happened outside of an officially declared recession (grey bars), and the lag between the peak LEI and the onset of the recession (retrospectively) has ranged from 1 to 20 months. The Conference Board explains on their website as follows:

As shown, since 1959, an LEI contraction of this magnitude has never happened outside of an officially declared recession (grey bars), and the lag between the peak LEI and the onset of the recession (retrospectively) has ranged from 1 to 20 months. The Conference Board explains on their website as follows:

“The decline continued to be fueled by gloomy consumer expectations, weak new orders, negative interest rate spread, and an increased number of initial claims for unemployment…Taken together, June’s data suggest that economic activity is likely to continue to lose momentum in the months ahead.”

If an NBER-declared US recession ends up being retrospectively dated as of October 2023, it will have been 22 months since the LEI peak in December 2021, second only to the 20-month lag that preceded the 2008 ‘great’ recession.

The discussion below offers further context on current economic trends, employment, and housing. It’s worth the listen.

Everyone’s getting fired across all industries, says Danielle. U.S. recession is here and the housing market is crashing. Here is a direct video link.