A 90-day pause on embargo-style US-China trade tariffs has revived bullish spirits. The large-cap S&P 500 (black below), with its one-third weight in tech companies (“Magnificent Seven” companies in orange), has rebounded 18% since April 8—now flat year to date and -3.8% below the February high.

The retail crowd is back at it, bidding the most popular meme stocks (pink below) up 25% since April 11, while the Goldman Sachs retail favourites basket (in blue) has rebounded 16.96%.

The retail crowd is back at it, bidding the most popular meme stocks (pink below) up 25% since April 11, while the Goldman Sachs retail favourites basket (in blue) has rebounded 16.96%.

It’s worth remembering that such dramatic rebounds are typical during ongoing bear markets, as the most-shorted stocks, which have fallen the most, get repurchased on profit-taking from short-sellers.

It’s worth remembering that such dramatic rebounds are typical during ongoing bear markets, as the most-shorted stocks, which have fallen the most, get repurchased on profit-taking from short-sellers.

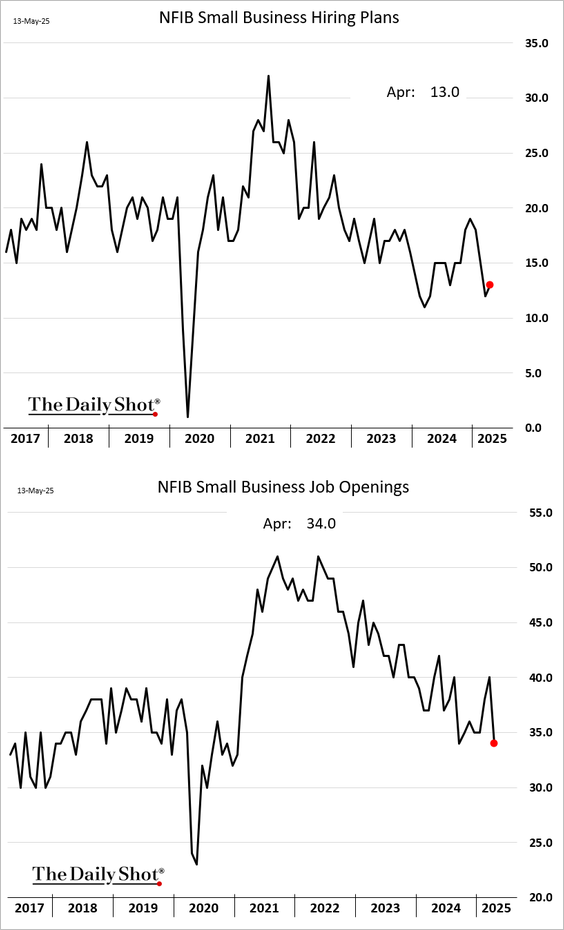

In the real economy, small business hiring plans and job openings have not rebounded (below, from 2017, courtesy of The Daily Shot).

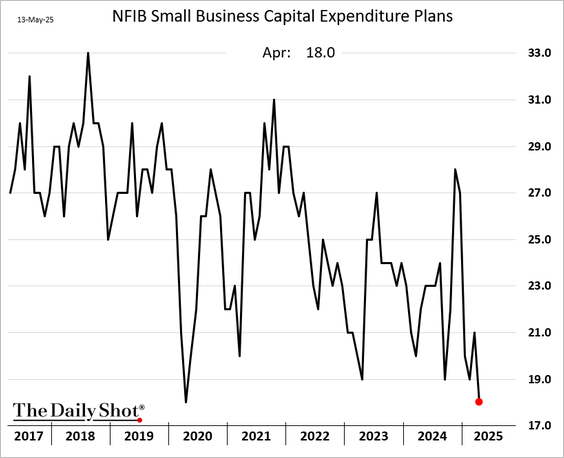

Nor have capital expenditure plans (below since 2017) that touched the COVID-lows in April. Making long-term capital allocation commitments is tough when government policy is wipsawing daily.

Nor have capital expenditure plans (below since 2017) that touched the COVID-lows in April. Making long-term capital allocation commitments is tough when government policy is wipsawing daily.

It’s hard to get a word edge-wise with David R. 🥸, but his economic content is always worth a mull. The discussion below covers many relevant observations.

David Rosenberg, Founder and President of Rosenberg Research & Associates, discusses the impending recession he forecasts for the second half of 2025 despite the recent US-China tariff reprieve. He recommends defensive investment strategies, including treasuries, gold, and low-beta equities. Here is a direct video link.

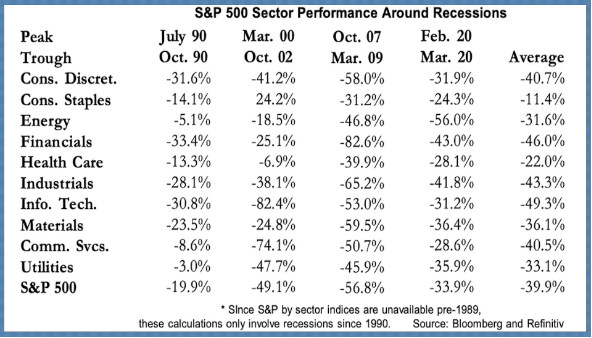

An important caveat emptor when discussing the ‘defensive’ quality of dividend-paying stocks and sectors: they may fall less during recessions, but they still tend to lose a lot (performance by sector versus the broad S&P 500 below since 1990, courtesy of A. Gary Shilling).