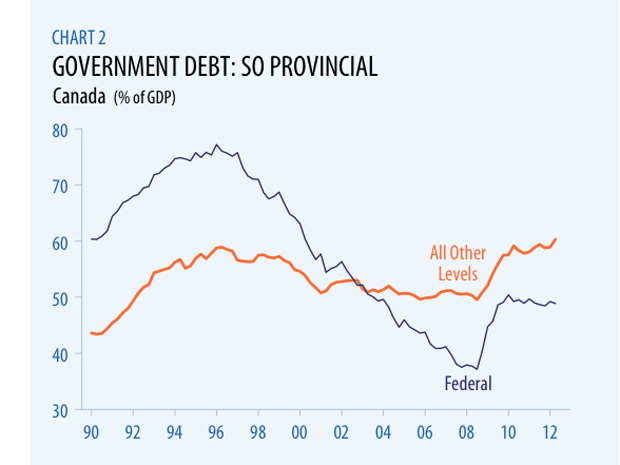

It is by now widely reported that Canadian household debt levels are perilously high at a record 163.4% in the second quarter. Less acknowledged however, is that total government debt has actually been growing at a higher rate than households since 2008 . A new report from BMO Capital Markets points out that rather than just chastising Canadian consumers for living beyond their means, the various levels of Canadian government should also be focusing on surging debt levels since the last recession. This trend is only likely to worsen over the next few quarters, as Canadian tax revenues weaken amid the incoming economic downturn. See: Canadian government debt has risen much faster than household debt since 2008

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

I know this is off topic, but the debt is funding madness such as this.

http://www.zerohedge.com/news/2012-11-01/fisker-karma-first-car-burn-underwater

It is a shame that governments have such a free reign on spending money. The political machines are more concerned on re-elections(all political parties) and buying their way with frivilous spending). It wasn’t too long ago Alberta had a terrific law that said the government could not go into deficit. Ironically when the party pushed out the leaders of the time the new leaders that replaced them went back to the old spend thrift ways and started spending more than they took in and went back into deficit. Of course to suit their needs they just changed the law so they could overspend. Don’t worry they say we have it under control. Tell that to the young children who will be left footing the bill.