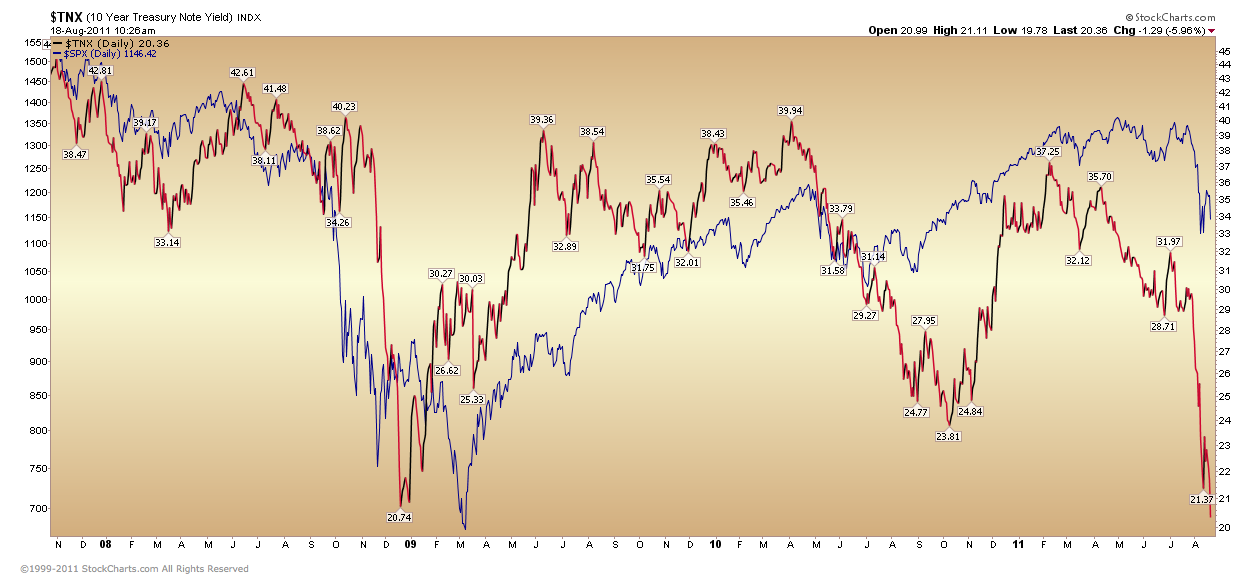

In the last recession, bonds yields bottomed in December 2008 when the 10 year treasury yield bounced at 2.074. Global stock markets bottomed 3 months later in March 2009. This morning the 10 year treasury yield took out that previous cycle low breaking to a new record below 2% (red line below). Last summer the chart shows that stocks (S&P 500 in blue) defied the gravity of falling bond yields for a few months from April to October as stocks popped on misplaced hopes for an economic boast from the Fed’s QE2. The world now understands that these hopes were misplaced.

The renewed support for bonds over the past 8 months aligns with our belief that we are likely already in or entering the next global recession. It also suggests that the next low for stocks is probably not yet in but may present in the next 3-6 months for those who are ready.

It feels like that we are pushing for the extreme lows on bond yields after 60 plus years. In the 30s or 40s, if I remember what I had read correctly, the Canada Gov’t 20 year bond yield was at 2%. JW, Vancouver.