Stock markets are roaring (at least so far this morning) in another day of madness and mayhem. Meanwhile North American bond yields are not joining in as bonds remain bid with the barometer US 10 year yield still holding below 2%. Everyday is one more scene from One Flew Over The Cuckoos’ Nest, as bankrupt entities announce tranche after tranche of financial support for one another. A glaring example today, was Japan’s promise to toss another 60 billion onto their own line of credit in order to give more to the IMF to help bail out Europe. “There must be one more credit card that we haven’t filled around here somewhere” seems to be the thinking.

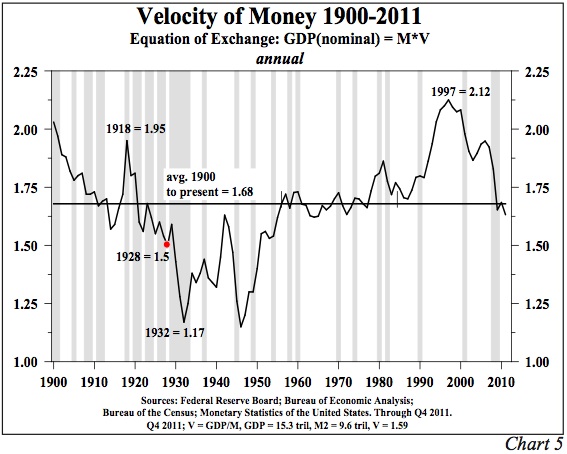

The trouble is this: more debt, creates more cash flow drag, creates slower growth, creates larger deficits, creates more debt. The velocity–movement of money through the real economy–plummets further with each round of debt-fueled stimulus and “rescue”. The below chart shows that money velocity today in the US (same for other countries) continues to contract, not in spite of all the intervention efforts, but precisely because of them.

Today Lacy Hunt’s Hoisington Q1 Review reminds anyone who is interested of the truth about debt-rescues:

Today Lacy Hunt’s Hoisington Q1 Review reminds anyone who is interested of the truth about debt-rescues:

“In 2011, the U.S. private and public debt to GDP ratio was about 174 percentage points higher than the post 1870 average. Comparably measured debt to GDP ratios are substantially higher in the Euro zone, the UK, Japan and even Canada, indicating that the debt issue is a global depressant to growth. To remove this growth impediment, debt needs to decline dramatically relative to GDP for a prolonged period. Contrary to common wisdom, monetary and fiscal policy actions that spur growth by increasing debt may buy transitory gains in some measures of economic activity, but they perpetuate this disequilibrium. Increasing debt merely makes the economy more vulnerable to economic weakness and potential instability because income growth is stunted or, as previously stated, over-indebtedness cannot be cured by more debt. Periods of over-indebtedness change the sacrosanct rules of thumb of business cycles. The conventional wisdom of business cycle analysis that suggests five to seven good years followed by one to two bad years is broken. Normal risk taking is not rewarded.” Read the whole article here.

Pingback: Debt-Fueled Rescues Killing Global Economy « Financial Survival Network

As someone with no debt currently, I hope the velocity of money stays low until all the money in the system can be either sterilized or gradually absorbed organically. The economy is still burdened by too much debt, hampered by lack of business investment, devoid of a major growth catalyst, hurting from poorly allocated labour/skills, suffering crowding out by the government, and struggling with regional imbalances.

Yet the amount of money brewing in the system is, to say the least, monstrous. When the prospects for growth in the economy and wages are weak, and the system is flooded with money, the last thing we need is for the velocity of money to rise sharply. If it begins to do so, I’ll be looking to take on a large self-liquidating debt. Or maybe I should be looking now?