Economic data this morning all confirming the thesis of incoming recession in the US:

- US initial jobless claims for the week came in at 386K, which is 21K higher than expected and last week’s 350K was upward revised up 352K

- The Philly Fed posted a July index print at -12.9, its third negative month in a row (expectations were for -8.0)

- Existing home sales were down 5.4% month to month in June and their biggest drop in 16 months as foreclosure supply surges.

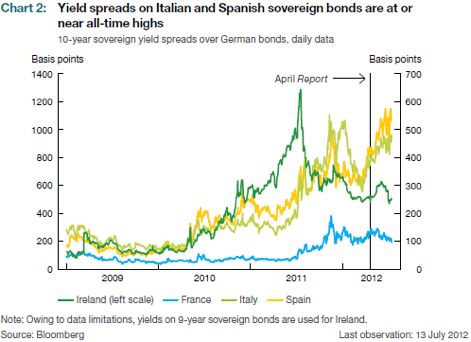

Meanwhile the Euro continues to slide as Italian and Spanish bond yields spike far above either country’s ability to pay (chart below) and Germany warns that Spain must be responsible for aiding its own banks.

Stock and commodity markets, in their ever hopeful state of denial, are so far staging yet another anemic rally on another day of “two guys trading” volume in bets that the quickening of the global downturn will soon force central banks to flood more liquidity into the financial system. North American bond markets and the US dollar remain unconvinced as both continue to see huge global inflows.

We look forward to the next tranche of panic-induced intervention, as the sooner we get it, the sooner the recognition that it will not avert the ongoing global recession and nor arrest the necessary downside needed in asset markets. Once we see this reversion to math and free market forces, we will finally be getting somewhere useful for investors and restoring the real economy.

I sure like your eternal optimism Danielle, but I am not so sure that QE3 will provide the much needed recognition to enough investors. After all, most of them are craving the next hit of heroin so there must be a strong belief QE works.