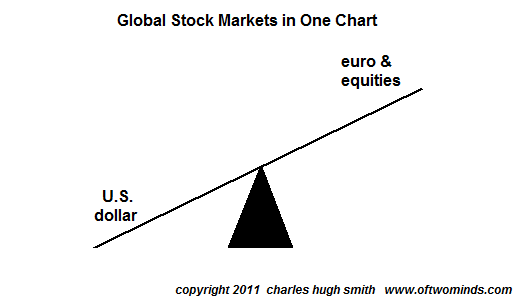

As the Euro falls below 1.21 versus the greenback this morning, the US dollar index moves toward a new cycle high at 84. Oil, gold and everything else considered a “risk trade” are down hard while the US 10-year Treasury yield falls to 1.40. Capital is flooding out of a hemorrhaging Euro zone desperate for safer parks. Traders will continue to bet on more liquidity from global central banks, but the truth is gradually getting out: central banks cannot overrule a recessing global economy. The teeter totter is asserting itself once more.

Follow

____________________________

Cory’s Chart Corner

Load MoreWow...RBC trying hard to obfuscate an 8x growth in loan losses with candy for the kiddies, buybacks and dividend hike. Morning other Danielle...

h/t @DiMartinoBoothDanielle DiMartino Booth @DiMartinoBoothBattening down the hatches with an eight-fold hike in loan loss provisions north of the border:

@RBC provisions for performing loans totaled C$568 million in the second quarter, up from C$68 million in the first three months of the fiscal year.

@business____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

Thanks Danielle for all the hard work you put into your blog. You are a great help to small investors such as myself.

There is no teeter-totter; it’s all the same. Europe looks worse because their central bank won’t (can’t) just print money. Countries with problem economies (Spain, Italy, Greece) are facing austerity and high interest rates because they are being forced to curtail their reckless spending. European countries are actually having to solve their problems. Meanwhile the US talks about the next QE as if that were a good thing when all it does is increase their total debt and resolves not a single debt. Only a country with the arrogance of the US cannot see this simple truth.

its rather a stretch to believe that the refugees from EuroLand are flocking to the US Dollar! at least for now they are, but our day of reckoning beckens also.

Mattress. Solvency. Summer!

Bernanke intends to print the US out of harms way. Yes, that will kill the US dollar, but thats the plan. Eradicate the debt by devaluation. Destroy the retiring boomers, but save the economy so the corporations can survive to hire the boomers children.

Isn’t it wonderful we have such a genius as Benjamin Bernanke? If you look carefully on a sunny day, you can actually see him peering out the window from his Ivory Tower. Don’t worry, he isn’t scared sI*9itless–he just looks that way. Hmmm, I wonder why?

Maybe its because he only has one little skinny arrow in that quiver, and if he misses, kaboom! Oz collapses.

Oh, psst. Don’t sell your physical gold yet. It will come in useful when ObamaCare means testing arrives. So far, there is no record of owning/holding it on your income tax form. So far as they know, you know nothing. NOTHING. 🙂