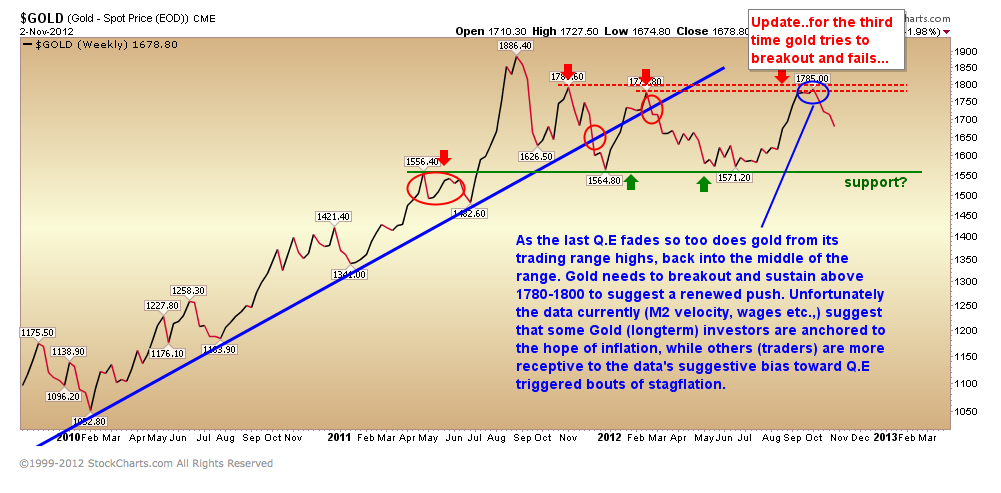

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Eclectica Asset Management manager Hugh Hendry at the Buttonwood Gathering 2012 talks about his views on gold, inflation, China and the global economy. Here is a direct link, Henry speaks for the first 21 minutes.

Hugh Hendry is spot on, on the topic of gold. However he’s completely “off the deep end” when he discusses a roadmap for China and the US. In the video above he thinks that economic contraction in the US will be (comparatively) mild and that economic contraction in China could amount to some 23%.

He reaches this conclusion by using a template of the UK and US in 1931. By doing so he effectively thinks that histry started in 1929. Thereby ignoring economic developments in both countries in the previous 30 to 60 years before 1930.

So much Gold hate here. Why? Have you been bearish the entire way up?