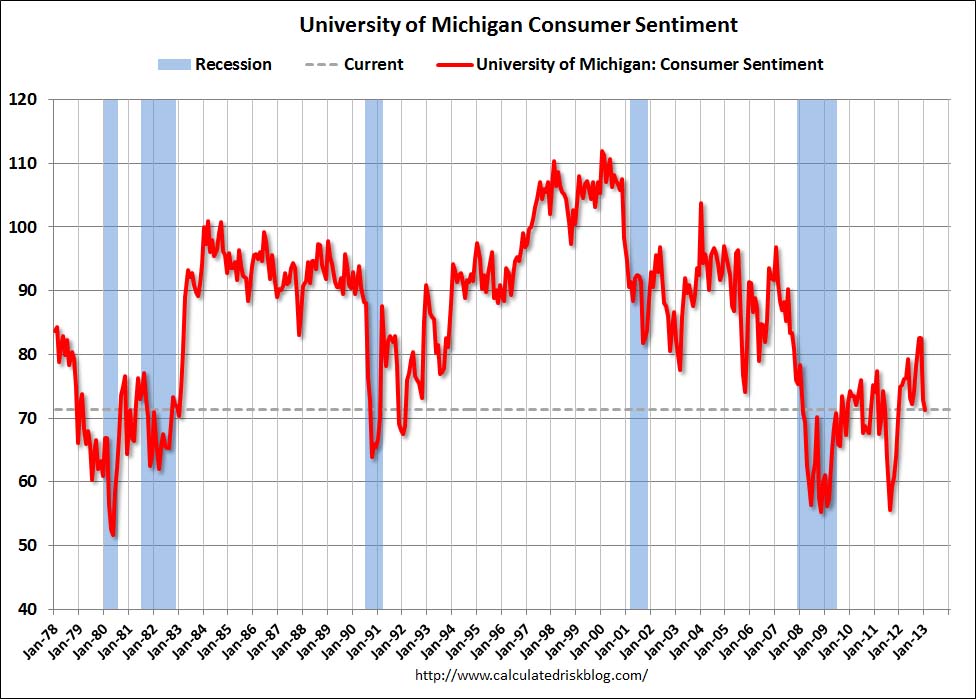

This morning the latest consumer sentiment data shows US consumers– still the relatively wealthiest consumers in the world –continue to feel pessimistic about their economic future. Sure, there have been a couple of hopeful spurts in early 2009 and 2011, but overall the chart below attests that US consumers have labored in various degrees of depressed sentiment since the heady euphoria of the late great secular bull in 2000.

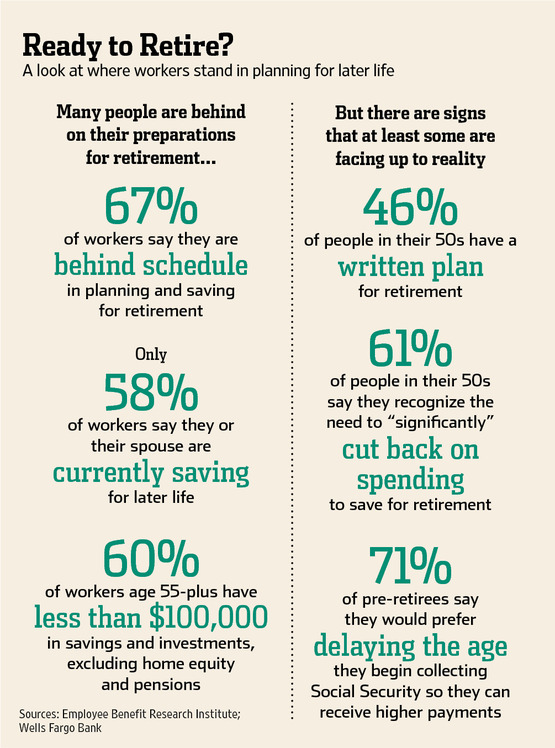

No doubt, there are some bankers and other elites who wax mystified at such trends. “Why in the world are the masses so gloomy?” they are wondering. I have a suggestion: despite the appearance of some material trappings, the masses are financially broke (physically too, but that’s another story). And for the first decade since the last two credit/housing busts in 1980 and 1990–they have come to know and feel their vulnerability. They feel it in their lack of savings, lack of cash flow, low to no home equity and lack of quick fixes. As shown in this next chart, 60% of workers aged 55 and older have less than $100,000 in liquid savings. Those under age 55 have much, much less.

Not only are people under-saved today, but the savings that they do have has earned typically negative returns now over the past 15 years, as stocks continue through a secular bear and interest rates have plunged toward the zero bound. Add under-employment and record debt levels to meager savings and we should fully comprehend why people are feeling low. All the while, marketing media taunts at every moment, about all the things we should want to consume.

There are important, life-changing lessons to be learned in all of this. Lessons about the danger of debt, and the folly of high spending rates. Lessons about the perils of ignoring this truth and placing ignorant faith in the investment sales crowd who repeatedly promise that they can magically make up for the client’s lack of savings and spending controls by plopping any savings they do have into risk “plays” at every price.

We see this today as we have seen it repeatedly since the late 90’s, as desperate people buy over-priced risk for tenuous short term “yield” in securities that are likely to come at a devastating cost to their unsuspecting capital once more.

The bottom line is this: when we do not want to accept facts before us and make prudent changes to our financial behavior as needed, then we are destined to suffer repeated harm, unless and until we do. This truth is timeless.

Based on reports in the news of companies moving from, say, Ontario to the US, and the apparent, on-going attempt in more and more states to eviscerate unions, it is somewhat surprising to find that (based on data from the BLS and StatsCan) that American workers are making comparable wages to Canadian workers, across the employment spectrum.

The US seems to be divided into two large groups: the haves and the have nots (not including the elites, who exist in a universe far, far away). Almost 50 million Americans now live at or below the poverty line (which is at the high range of the long-term trend channel as a percentage of population, since around the 1960s). The labour participation rate is at levels not seen since before women starting entering the work force permanently and en masse. Equity took a bath since the housing correction. Consumer debt still too high.

And yet, those with jobs have seen there incomes steadily rising (perhaps lover than inflation but still rising). What this says to me, vis-a-vis Canada, is that in order for American companies to find Canadian employees attractive, there needs to be a very large discrepancy in costs. So either the Canadian dollar has to be much lower than the America dollar, or Canadian labour costs have to be much lower (or a combination of both). If companies like Caterpillar and GM, just to name two, are finding it cheaper to do business in the US (where corporate taxes are higher, I believe) even though American workers are being paid the same as Canadian workers, this does not bode well for Canadian labour if the dollar stays at these historic highs.

The US appears to have the potential to become much more self-sufficient with cheaper real estate in many places and an abundance of natural resources (namely oil and gas–who needs the oil sands?). Are US companies going to look increasingly inward to the United States as both the main source of production and consumption for goods and services? Is Canada, with it’s comparable labour costs, high dollar, expensive real estate and expensive energy going to be literally left out in the cold?

Well then, they need to learn how to invest properly. That is, they need to do it themselves. Leaving investing to others is just plain dumb. In the land of little returns, they need to do some homework and learn who the earnings champs are, and there are plenty of them out there. The shale gas revolution is just coming online and it will make America one very rich nation and so powerful. Obama is one lucky boy on this account. It is he who will deal out the leases on the Federal lands and with the monies he will save America and the New New Deal. Count on it.

The changing face of investment banking

http://m.spiegel.de/international/business/a-877710.html

From what I’ve read, there are huge oil shale deposits in Colorado, Utah and Wyoming. But I don’t believe they are trying to produce those. From what I’ve read the fields in the Dakotas are quite small and will not make a large dent in the oil supply for the US. I think oil supply will probably continue to be a big problem for the US due to our huge consumption. If the economy tanks, then the supply problem could disappear – but it would take a very, very deep depression to get demand down anywhere near domestic oil production levels.

On the issue of savings, I do get tired of hearing about how the young people have so much less saved than older workers. I think that’s kind of the way it’s supposed to work, eh? It used to be that the American dream was that if you worked your ass off and scrimped and saved for 40 years you were supposed to accumulate some wealth. I suppose under the Oblabbinator the youngins that voted for him think he should fill their bank accounts – after all, he’s giving the illegals and banksters all kinds of perks (so they’ll vote DemocRAT), the youngins might as well get theirs!

Abundant oil not likely:

http://www.zerohedge.com/news/2013-01-20/guest-postgregor-macdonald-what-end-cheap-oil-means

FACTS:

Domestic crude oil production for the US: 5,700,000 barrels/day

Domestic crude oil consumption for the US: 18,800,000 barrels/day

Source:

http://www.eia.gov/energyexplained/index.cfm?page=oil_home#tab2