The desperation for yield has been unprecedented this cycle as central banks encouraged epic mal-investment through repeated bouts of quantitative madness since 2010.

High yield debt became an oxymoron with the riskiest corporate bonds paying investment-grade-like-rates of 5% and less into 2014. In reality such low rates never were enough to compensate for the capital loss risk taken and corporations responded to irrational buyers by selling them more low-yield debt. Weakening their credit quality further, this has driven the amount of debt on corporate balance sheets to twice the level seen before the 2008 credit meltdown.

We should not be surprised then to see that ‘high yield’ bonds have dropping in value since 2013. As shown below from $96.29 in May of 2013 the high yield bond index (HYG) has fallen just under 14% to date and is now back at the same price is was in 2010.

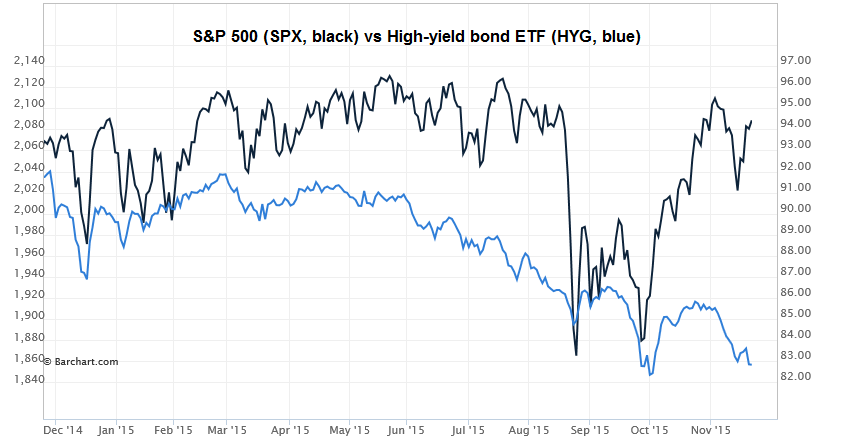

Given the historical correlation between corporate debt (blue below) and equities (S&P in black) this weakness in credit should alarm today’s buy and hold stock investors. Unfortunately they won’t likely awake until more severe capital damage has been done to their savings. Then they will panic and sell when they should be liquid and buying. And so the cycle goes…

chart source: www.hussmanfunds.com