As politicians prattle about how they “make jobs” and business leaders boast about how they are the true “job creators”, the humble truth is that customers create jobs. To have sustained consumer spending, customers need–not even more credit on credit or emergency hand outs–customers need earnings. However the official methods try to estimate progress on the jobs front, (only to revise numbers lower once the real data is tabulated) the truth is found in the following chart of the change in average hourly earnings. It is clear that while some jobs have been added over the past 4 years, they have been funded by wage losses in the workforce.

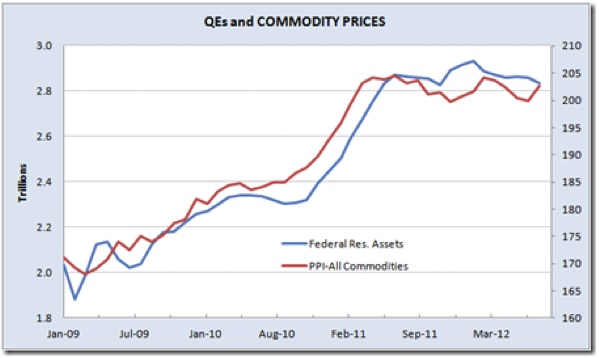

What’s more the repeated stimulus interventions of Central Banks have directly exasperated this trend toward lower hourly earnings, because QE liquidity flows not into the real economy, but directly into asset speculation. As QE flows push up commodity prices, companies offset the increase in their expenses by restricting wage growth.

The fact is that we are in a slow growth world and will be for a few more years as the weight of debt is worked off and written down. It is likely that wages in the west will continue to be under pressure through this period. What needs to happen however is that central banks must stop goosing asset prices so that input costs can come down as they must to reflect the reality of lower global demand. This will leave companies with more cash flow to pay wages. In addition, once share prices are lower, investors will be able to collect higher dividend yields without companies having to keep increasing their payouts to shareholders. This will leave companies with more cash flow to pay wages. And lastly, executives must take less for their own compensation in this new “post credit bubble” world. They have been outrageously over-paid over the past 20 years as executive compensation swelled to 300 x the average worker. This too will leave more cash flow for capital re-investment and wages for the workforce. These are the keys to bringing customers back into the economy. More customers will bring more jobs and wage growth. The rest is just noise and bluster.

“The fact is that we are in a slow growth world and will be for a few more years as the weight of debt is worked off and written down.”

Incorrect. The debt will never be worked off or written down – not in a few years – not ever. It is well beyond that. It WILL BE inflated away. How many iterations of money printing do people require before this is accepted?

Thanks for sharing. Excellent points supported by charts reflect the relevant statistics. I must say this is one of your best posts. Increase profitability by wage deflation (lost of good paying jobs). It has been going on for ~ 15 years. This is a slow motion chain reaction. Everyone can see it coming except the ones deny it. Langley, BC

Another great post Danielle.

Your points are all valid and I’d say this is one of your best posts.

Things need to be rebalanced to get the 99% enjoying some real prosperity again and starting a virtuous business cycle. Without money in our pockets, we can’t spend. It looks like individuals and families are finally hitting a debt ceiling that had been making up the difference (due to lack of wages) but that too must end.