This headline perfectly encapsulates the dominant strategy being pursued by governments and financial firms today. See: Greece agrees to borrow to buy back debt

“With Greece’s coffers nearly empty, the government said Wednesday that it would have to borrow 10 billion to 14 billion euros to pay for a debt buyback that its international creditors have demanded in exchange for releasing more bailout money to the troubled country.

The finance minister, Yannis Stournaras, said the strategy of buying back debt from bondholders at a discount needed to succeed as a matter of “patriotic duty.”

You really can’t make this stuff up. The world is engulfed in a frenzy of paying off one credit card with another. Round and round it goes.

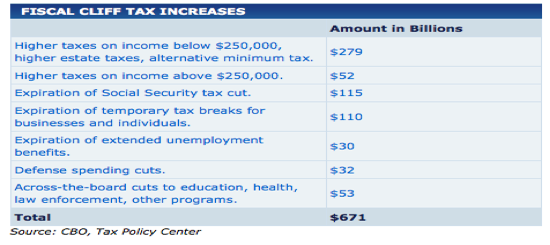

Meanwhile stocks are up this morning on rumors that the American congress is making progress on “fiscal cliff” discussions. For those that can follow basic math, the chart below summarizes the numbers presently on the table.

So if the entire “fiscal cliff” hits in January, the total cash flow improvement to the US is estimated at $671 billion. Presently the government is spending about 1 trillion a year more than it is taking in. So best case scenario for the debt issue, is that they come to no agreement and the full “cliff” does hit in the New Year. But this will still add at least 400 billion to the the US 16 trillion dollar national debt tab in 2013. And this deficit will certainly grow larger either way in 2013, as GDP weakens amid the global recession.

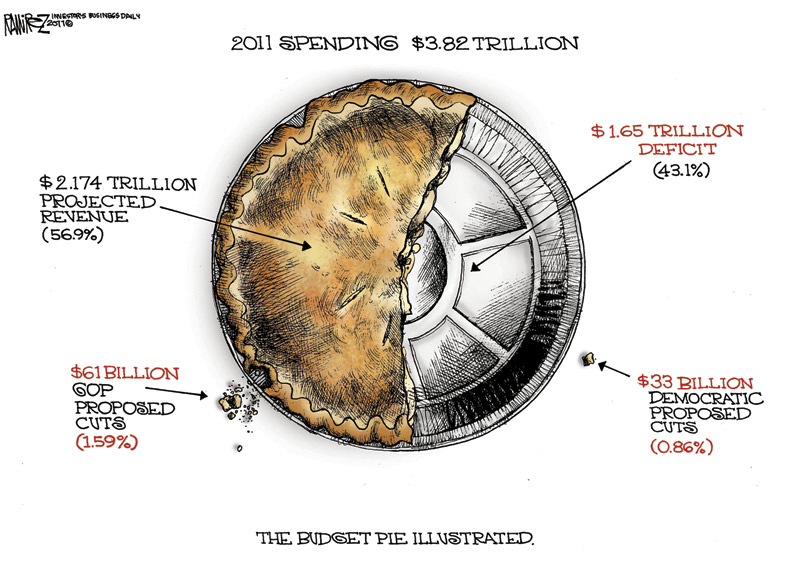

If Congress is able to come to the “rescue” and defer parts of the presently slated tax hikes and spending cuts (both of which are desperately needed but a joke compared with what is actually required to address the debt bomb), then the deficit is certain to add much more than 400 billion to debt in 2013. In fact since both sides are agreed that tax hikes for those earning less 250K must not pass, then the chart above reminds us that the cash flow benefit of the remaining slated cuts and tax hikes would amount to just 392 billion. This means that the federal government would “only” be spending about 600 billion more than they take in during 2013. Time to brush off this 2011 cartoon which perfectly captured the absurdity of these discussions last year when the debt ceiling limit was increased yet again.