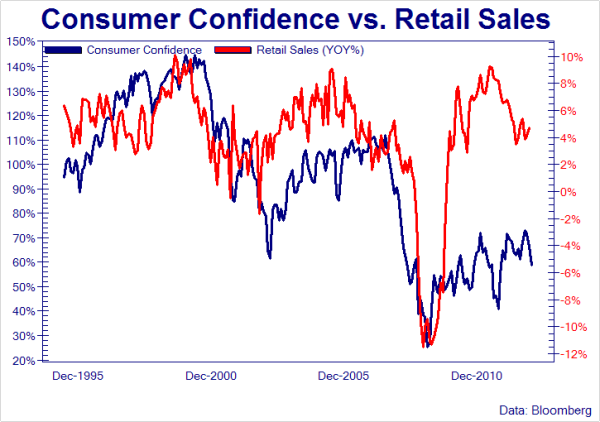

As this morning’s plunging consumer confidence number beckons retail sales and small business sentiment lower, Bernanke’s Fed meets to survey their actions to date in a world of “let’s pretend QE is helping the real economy.”

This clips offers a reminder of the magnitude committed to the failed scheme to date. Here is a direct link.

Follow

____________________________

Cory’s Chart Corner

Load More____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

[email-subscribers-form id="1"]This Month

Archives

Log In

I see 3 “steps” in the graph of consumer confidence; roughly 140, 110 and 70. Each is lower than the previous – does that indicate the next one will be even lower?

Retail sales seems to have steps also, but sales seem to rebound fairly well even when consumer confidence is low. Looks like YOY sales are running at roughly 6%.

What does it all mean?

Probably DP is implying there is a disconnect between the various effects of QE, that the mainstream business media (MSbM) does not report in detail. The MSbM contantly harps on about the positive effects of QE on stock and financial markets, but does not report the effects on the “real economy” in anywhere near the same detail.

Thankfully, we have available a shadow-MSbM in the form of knowledgable folks like Danielle who tell us in more detail the possible downstream ramifications of things the MSbM glosses over. Things like falling consumer confidence which might indicate falling consumer sales in the future. Quite an important consideration if consumer sales are about 70% of the economy or if you are holding consumer descretionary stocks.

It seems that only ECRI are willing to tell us what is going on in the real economy; but they have been quite absent from the MSbM since late last year, when they explained why they believed the US was in or close to a recession.

The fiscal can is going roll back down the hill and crush Bernanke. He knows it too. I’m surprised he doesn’t get carpel tunnel of the jawbone, like Larry Kudlow.

Hold your fire. It won’t be long now. End of the month jitters coming along, you can sense them if you know how to read charts properly.