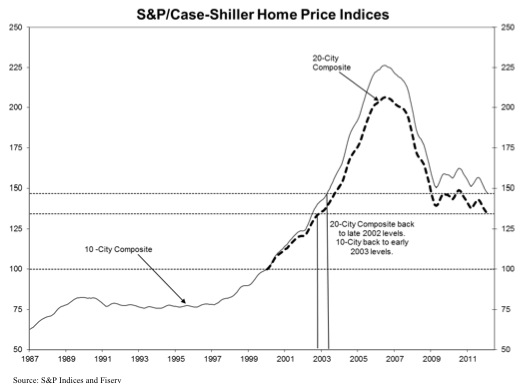

The Standard & Poor’s/Case-Shiller index this morning shows that US home prices dropped in February in 16 out of 20 major cities for a sixth straight month. The 20 city composite is now down to price levels from late 2002. Here is the chart.

On the upside this means US home prices have now given back 10 years of bubbledom which means the housing market there is much further along in the necessary downside work and healing process, than the still nutty Canadian, Australian and Chinese markets.

On the upside this means US home prices have now given back 10 years of bubbledom which means the housing market there is much further along in the necessary downside work and healing process, than the still nutty Canadian, Australian and Chinese markets.

For more on the Canadian market risks see this excellent article by housing and credit analyst Ben Rabidoux: The under-the-radar changes that may soon deflate (or pop) the housing bubble. Here is Ben:

“The next decade for real estate in Canada will be fundamentally different from the last. Our aging population, a mismatch between where our prices are and where they should be based on our economic performance, and rising interest rates are all reasons for this. However, the greatest difference will be in the availability of credit going forward, and those who try to explain real estate prices in Canada without acknowledging the role of easy, accessible credit over the past ten years or so have completely missed the boat.”

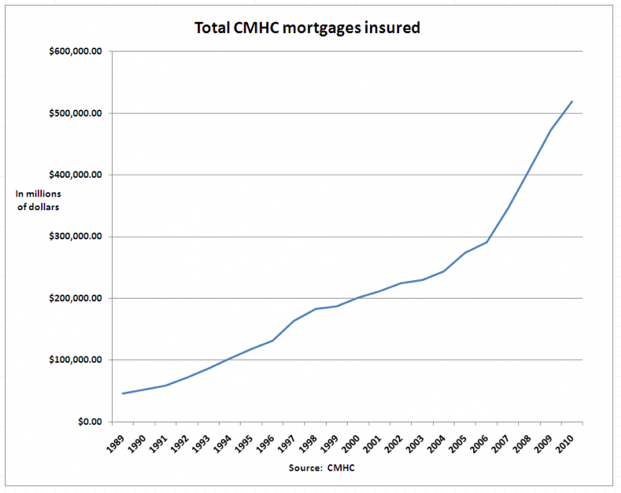

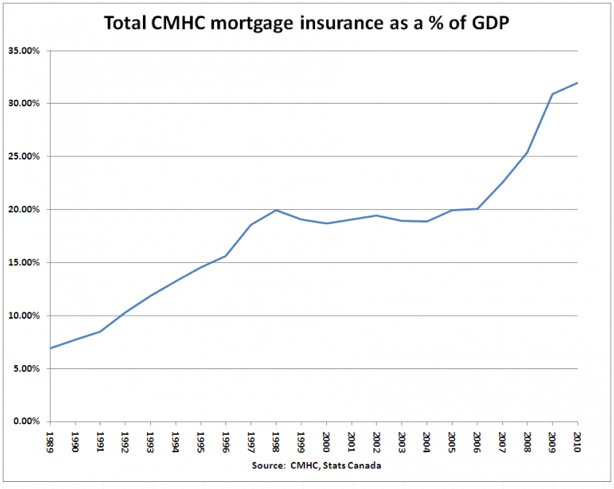

Very disturbing is the fact that the Canadian government has increased the cap several times on the amount of mortgages back-stopped for Canadian banks by the Canadian Mortgage and Housing Corporation so that today Canadian tax payers have underwritten nearly 50% of the 1.1 trillion dollar mortgage market. An increase of 70% in just the past 4 years. And accelerating just as Canada has one of the most over-valued realty markets in the world. Here is the chart of CMHC (tax-payor) backed mortgages.

This is a track of train-wreck coming to the highly indebted, hopelessly naive and dangerously under-saved aging population in Canada. Of course, the bankers and politicians who orchestrated all of this genius could not possibly have seen these problems coming. Of course not.

Coming train wreck indeed! If the worst comes to pass then taxpayers will definitely be stuck with the sizable bill for the CMHC writeoffs and other economic fallout. But some of us are ALREADY paying for this bubble. My property taxes have gone through roof over the past decade because people are bidding up prices in this neighbourhood to outrageous levels and thereby inflating overall property tax assessments. It is fine for the few people who want to sell and cash out, but not for those like me who want to continue to live in our houses in this neighbourhood. My new next door neighbour is typical, he is up to his neck in mortgage debt. I condemn irresponsible jackasses like him as well as the government for facilitating their behaviour by readily increasing the CMHC cap as Ms. Park points out.

The truly sad (and embarrassing) part is that we could see this coming from miles away because we have the disastrous experience of our friends below the 49th. It’s almost a perfect template of what NOT to do. Oh, but Canada doesn’t have sub-prime, right? Canadian mortgage brokers and banks don’t engage in irresponsible lending and fraud, right? We are not Americans, after all; we are smarter… right?

What stage in a mania is “denial” again? Oh, I forgot; in Canada it’s at every stage.

But Canada is soooooo far north, and so coooooold. Why are prices rising up there so much? My problem here in Chicagoland (still cold, but not this year) is the property taxes. Teardowns. And the homes going up are 850,000 to 2,500,000. And you know what that will do to the tax base. Yeck. I guess its all about location after all. Close to the freeways, malls, hospitals, shopping.

Maybe it is time to bug out afterall.