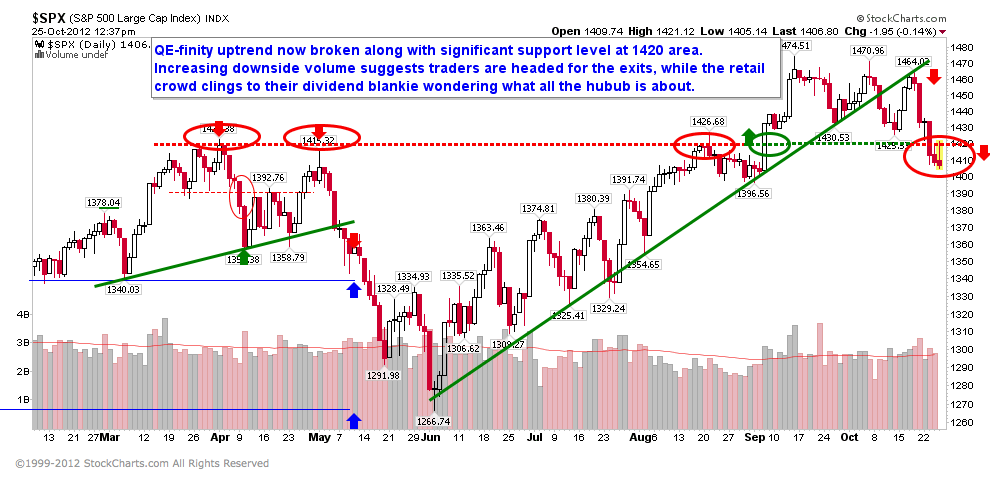

Not 6 weeks after the US Fed pledged Q’Efiniity injections, the S&P 500 has not only given back all of its initial gains made on that announcement, but has also broken below the top it forged on QE2 stimulus last spring. The Canadian TSX too is following global growth down and is now a full 16% lower than its nearest cycle peak 18 months ago in April 2011.

Source: Cory Venable, CMT, Cory Venable Investment Counsel Inc.

The catalysts for selling pressure in the 4th quarter are many in my view. Key ones include:

- Stock and commodity prices have been over-priced on repeated central bank intervention the past 3 years and now bear little rational connection to corporate revenue and growth prospects over the next 3 to 12 months as the global recession spreads.

- The low rate world is increasingly forcing savers to consume income and capital to pay their bills. After 15 years of losing money in stocks, few today are happy with risk or banking on long-term hopes.

- Global markets were negative year-to-date for the first 6 months of 2012. This followed a flat and negative year in 2011. Money managers and individual investors who saw a short rebound in account values on central bank stimulus July through September, and have the ability to lock that in by reducing market exposure, are keen to take the Fed gift and do so in order to report calendar year “returns” for 2012.

- US investors face the prospect of a dramatic jump in the capital gains tax rate in 2013. Selling before the end of 2012 reduces tax risk. Capital gain tax rates in 2013 may well be higher–in any case, they certainly won’t be lower.

- The outcome of the US election is polling ‘hard to call’. It could result in a protracted tabulation period a la 2001, before a clear winner is announced. Meanwhile the debt ceiling looms once more and could require negotiations in the midst of the electoral storm. In every outcome, the US faces a fiscal drag of 1-1.5% in early 2013 even assuming they delay the ‘fiscal cliff”. Current stall speed growth becomes negative quite easily in this scenario.

Reasons to continue holding stocks in these conditions?? I can think of a few:

- Hope and a prayer that central bank injections will be able to hold off asset deflation a while longer.

- Ignorance of secular bear cycles.

- Long-always advisers and managers who are motivated by their own fee income to keep client capital in risk markets at all cost. Even when the prospects of loss far outweigh the probabilities for lasting gains.

I didn’t hear much about the “fiscal cliff” in the US main stream media. Seems both Republicans and Democrats are supporting that “fiscal cliff” including the rise in capital gain tax. So, it seems inevitable that it’s going to happen.

Technically if you look further back the S&P is still above longer term trendlines support coming in around 1396 and if that gets broken there is an even longer upward trendline offering support around 1282 or so. If those one or both of those get taken out then I would be a tad nervous. I wouldn’t head for the exits just yet

I have been following your blog for almost 4 years and you never say anything different.

“Sell your stock and be in cash”….. well we can’t be in cash for ever. How about some real advice for your followers. We deserve at least that for following your blog all these years.

Seriously at what point will you admit you have been wrong. All year you have been drawing fancy charts on why the market will be going way down. Yet the market is up about 15%. How some technical work on when you would go long or are you allowing your personal views distort the technicals.

We have our own rule set and we have followed it to our clients’ benefit for many years. We are one of the few managers of any kind who has made and retained annual and compound returns year after year during this secular bear market. If you have your own method that works, by all means use it. If you do you should have no reason to attack us for ours. Good luck.

Actually Mike, you have not been understanding. It sounds like you are frustrated with your own method or lack there of. Our management method has had us heavily in fixed income over the past few years, in and out of the US dollar a few times to capture equity like gains, as well as a sell on equities in 2007, a buy in the Spring of 2009, and a sell again in 2010. We have definitely not been only in cash. In following our discipline, we have managed to make and retain positive returns year over year through one of the most difficult investment climates in market history. A feat that less than 5% of all managers can claim over the same time frame. And as far as what I owe you for reading my free blog….

Overall I agree with Danielle’s general approach to investing. However trying to use technical analysis in a highly manipulated market to make (relatively) short term predictions is not very useful IMHO.

and we don’t…

One important indicator suggests that the S&P 500 is going down from here. Including a new stockmarket crash.

Anyone who has investible assets has to develope his own ruleset. Those who depend on a blog, any blog, for advice on where to put their money are clearly not sophisticated enough to be making responsible decisions about their capital.

I would just like to add …..

I have been managing my own accounts for several years now and I share many of Danielle’s views. I do however take a different approach, perhaps a less certain or less rigid approach, but it has worked well for me and I too have had no year over year losses.

“Thematic investors, those who stick to one investment theme (bullish, bearish, the coming gold rush, whatever…) have not and will not make money in this market. One must look at the charts, strategize, and be willing to revamp that strategy quickly if proven wrong.” …..Keith Richards

Although this approach may not be what one should consider long term investing advice I think it is appropriate for the times we are living through.

Any one who does not have the time, the interest or the resources to make their own investment decisions should either stay out of the markets or be willing to pay for good advice.

There really are no free lunchs for the many, that buffet is reserved for the elite’s.