When fear and uncertainty rock the world, captive capital (hey, it’s excess capital, it has to go somewhere) flows back to the US global benchmark currency and its bond market as the deepest, most transparent and liquid markets in the world. I have been writing about this simple, key reality for years now but I find many people still misunderstand or under-estimate the importance of this dynamic to their portfolio. People get distracted by individual company and sector stories, all the colourful graphics, brochures, charts, their own feelings, hopes, other personalities and the shiny teeth on television, and they miss the few key things that matter most to how their savings fare over time.

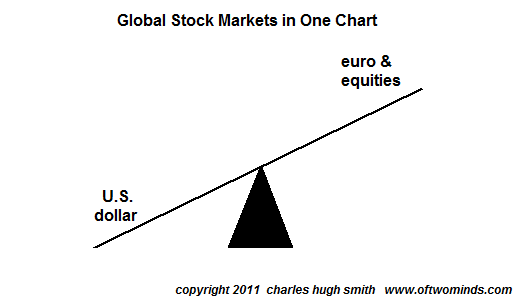

Today I was delighted to find this chart vividly capturing the dynamic via Zerohedge, see: Could the Euro trigger a 2008-like crash? Si, oui, yes.

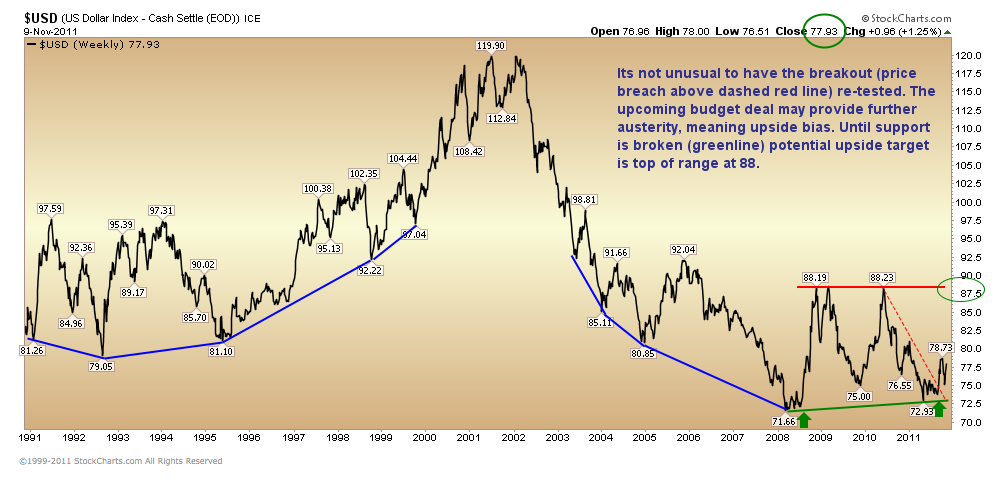

Here is our real-time version of this barometer at Venable Park which we have used as a key indicator for years now. Bottom line: if the U$ continues an interim rally even over the next few weeks or months as Europe wobbles, this is a key storm warning for continued downside risk to stocks and commodities:

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

” The Proof is in the Pudding”

A managed ETF run by one of the “still” most celebrated analysts(letter writer)….how do you turn $10.00(before fees) into $8.00 when your starting point is the beginning of one of the biggest bear market rallies ever and still have the “stuff” to get in front of a camera……. unfortunately he is not alone.

http://stockcharts.com/h-sc/ui?s=HAG.TO&p=D&yr=3&mn=0&dy=0&id=p42325919690