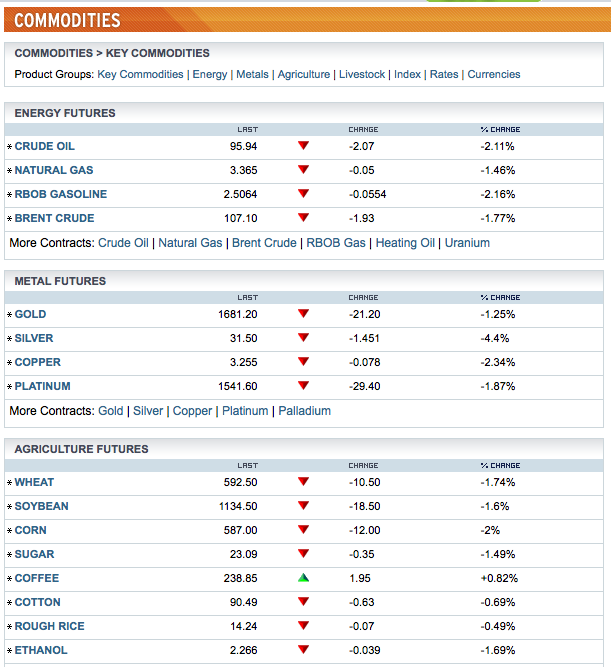

Over-levered people and institutions are continuing in their predictable dash for cash; prompting mass liquidation across most risk assets including gold, silver and other commodities. What is black and white and red all over? Our highly correlated global risk markets in the midst of a cyclical bear market.

Losses to date are likely just a warm up phase to the bulk of the downside which typically comes after we receive retrospective confirmation of the global recession. I believe we have already started into recession in most countries, but we are not likely to see official confirmation of this until a few months hence looking back on present data. The Canadian dollar–the bastion of much over-confidence the past year–is also rightfully getting its comeuppance:

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

For those frozen in the midst of this, or still sipping the hold and hope koolaid from their long-always advisors, it is still not too late to wake up. Please remember 2001-2002 and 2008. Denial is painful:

So where do you make money? Savings rate below inflation, investments no good, R/E bubble going to implode, metals being sold off en masse.

Year to date postive returns have been made on high quality bonds, U$ tbills and cash. The next buying opportunity for riskier assets lies ahead, after the recession has been confirmed.

A Bond Bull Sees More Deflation Ahead

http://www.zerohedge.com/contributed/bond-bull-sees-more-deflation-ahead

I am one of the people that have shaken violently awake from the buy & hold bank hypnosis that I allowed myself to be subjected to. September was the “finger snap” that made me re-evaluate what my VSE trained co-worker emplored to me. He said that time out of the market is just that. It is linear. It has no bearing on the future, but if you are out too long, then the results of compounding will be delayed.

Anyway, I am not very literate financially & am sitting in cash. Couldn’t inverse ETF’s be accumulated for now? (Bad) Economic events seem to be taking place right now with more & more speed. Maybe the inverse trade is the only one left. When I look at how these things chart, though, I don’t see an inverse pattern as much as a choppy one. Do these things behave the way they are supposedly designed to?

So, deflation is your mantra. Do you believe hyperinflation will occur once deflation is played out?

no way to know that at this point. It is possible but not probable in the near term (ie. next year or two).