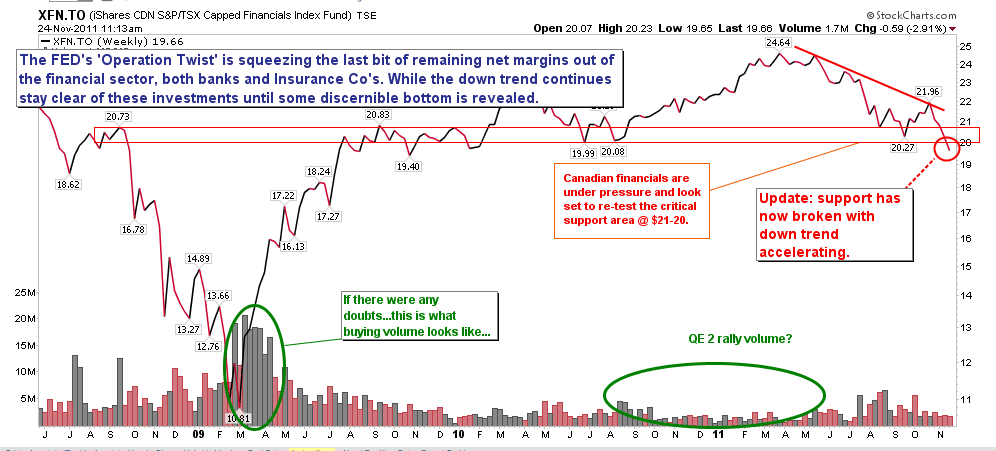

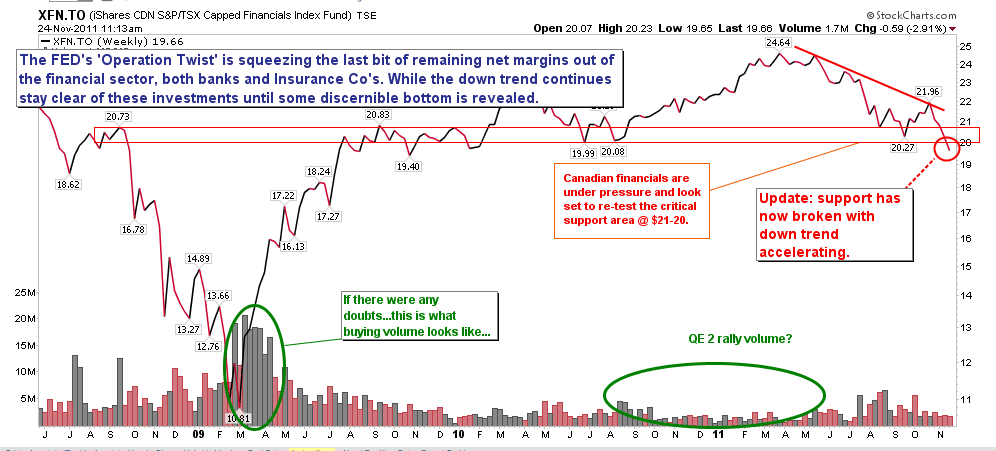

Canadian financials (like others around the world) are falling hard here, stand back. Remember dividends are no salve for missing limbs.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc

Canadian financials (like others around the world) are falling hard here, stand back. Remember dividends are no salve for missing limbs.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc

Love the charts, Thank you! Cory. Now, the 1.25% interest on the High Interest Saving Account looks attractive. For some reason, I have a nasty feeling that we probably won’t see a sharp rebound like 2009 even with another QE. Patience is the essence. My 2 cents. JW, Vancouver

Time will tell…Thanks for the feedback it’s greatly appreciated. C

This reminds me when I met a CIBC investment team, and came upon a prig who considered himself an “economics historian”, yet still had no idea what constituted a liquidity trap. Anyhow, this chap reckoned confidently that Canadian financials would double/triple in price in a few years. A few years have passed…

If Canadian financials are having problems, and a global recession is putting downward pressure on commodity prices, revealing a distinct lack of Canadian productivity, two things come to mind: both loonie and Canadian equities are overvalued.

Hi Danielle,

Thanks for continually beating us over the head with your reality stick. No one can say they weren`t forewarned again and again. I notice that the financial media continues to state that the problem with the markets is the uncertainty over the Eurozone and it will soon be `fixed` and then global markets will turn back up with the seasonally strong period for equities. Yes, Europe is now dealing with its day of reckoning but do you think this is only a prelude to the day of reckoning for the US. Do you think the US is really in more trouble and has just kicked its problems down the road a bit further with all the printing of money. Could the meltdown of the US be the catalyst for the next cyclical bull market.